Media Usage

Trends in Media Usage

Media consumption has grown continuously in recent years. People in Germany use media and media transmission channels for a total of 11.5 hours every day. Although a wide range of services is available, television continues to dominate media usage.

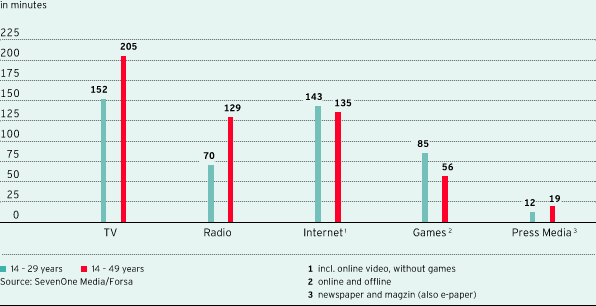

Television remains the main medium for the target group of 14 to 49 year olds, with a daily use time of just under 205 minutes — well ahead of the internet (135 minutes), radio (129 minutes) and print (19 minutes). In the younger age group of 14 to 29 year olds, TV comes out on top as well, with a daily use time of 152 minutes. This is shown by the latest results of the “Media Activity Guide 2014” study by ProSiebenSat.1 advertising sales company SevenOne Media. The internet follows in second place, with a use time of 143 minutes. In contrast, print media are continuing to decline in importance: 14 to 49 year olds now spend 19 minutes per day reading newspapers and magazines, while for 14 to 29 year olds this figure is 12 minutes. Much more time is available for gaming, however, with 14 to 29 year olds playing for an average of more than 80 minutes per day.

Average daily use time

Digital media have become a firmly established part of everyday life for many users. According to the results of the “ARD/ZDF Online Study 2014”, the proportion of internet users in Germany rose to 79.1 % in 2014. Video consumption is among the online content that is achieving the fastest growth: On average, users in Germany spend 10 minutes every day watching online videos. This trend is expected to intensify over the next few years. At present, 45 % of those surveyed who were aged 14 and over watch video content online at least once a week. 34 % access video portals, 14 % watch TV after a time delay and 8 % watch it live, while 9 % use broadcasters’ media libraries. 6 % of those surveyed follow video podcasts and 4 % use video streaming services.

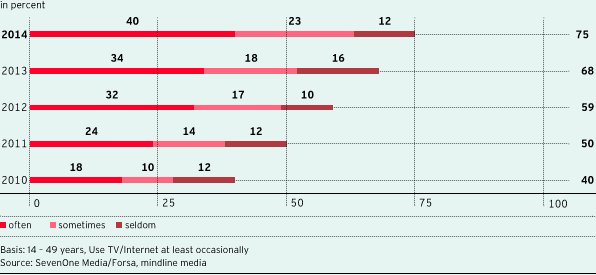

The growing significance of the internet as a separate mass medium has made lasting changes to consumption behavior. TV and internet are nowadays frequently used in parallel. This aspect is discussed under the keyword “second screen”. In many households, one or more second-screen devices can already be found alongside the television, with a growing pervasion of tablets and smartphones in particular: Six out of ten households now have at least one smartphone, while every fourth household has a tablet. According to a recent study by PricewaterhouseCoopers (PwC), around 60 % of the German population will have a tablet by 2018. Parallel use of TV and internet has grown significantly since 2010. In the “Media Activity Guide 2014” study conducted by SevenOne Media, 75 % of those surveyed who were aged between 14 and 49 said that they watched television and surfed the internet at the same time. According to the “ARD/ZDF Online Study 2014”, however, this trend has not yet led to any major changes in media usage time: The internet and TV are not cannibalizing each other, but rather are two complementary media.

Parallel usage TV/Internet

In the gross advertising market, television is the medium with the greatest relevance — not only because of its reach and use time, but also due to its high advertising impact. Television advertising binds consumers to brands in the long term and ensures their lasting success. Investments in TV advertising are thus essential and pay off equally in the short and long term. SevenOne Media demonstrated this in the joint study “ROI Analyzer” with GfK Fernsehforschung and the GfK Verein in 2014. The study evaluated the effects of TV advertising on all purchase data from 30,000 German households over a year. The results showed that, across all brands investigated, a TV campaign will pay for itself after only one year, with an average return on investment (ROI) of 1.15. This increases to 2.65 after five years.

Development of the Audience Market

The six free TV stations ProSieben, SAT.1, kabel eins, sixx, SAT.1 Gold and ProSieben MAXX achieved a combined market share of 28.7 % among viewers aged between 14 and 49 in 2014 (previous year: 28.1 %). This equates to growth of 0.6 percentage points year-on-year. The ProSiebenSat.1 Group thus further enhanced its leading market position despite the broadcast of the Winter Olympics and the soccer World Cup on the public stations. With a lead of 4.1 percentage points, ProSiebenSat.1’s stations were once again well ahead of the stations marketed by IP (RTL, VOX, n-tv, Super RTL, RTL Nitro) in 2014. Its direct competitor lost 1.4 percentage points year-on-year (previous year: 26.1 %).

Our growth was mainly driven by the newer TV stations sixx, SAT.1 Gold and ProSieben MAXX. In recent years, the ProSiebenSat.1 Group has expanded its complementary portfolio with TV stations that appeal to new, specific target groups in the audience and advertising market. While sixx and SAT.1 Gold reach mainly female viewers, the station ProSieben MAXX is primarily geared towards a male audience.

ProSieben generated a market share of 11.0 % of viewers aged 14 to 49 in 2014 (previous year: 11.4 %). This corresponds to 2.4 percentage points less than its competitor RTL — the smallest gap in the broadcaster’s history (previous year: 3.2 percentage points). In the relevant target group of 14 to 39 year olds, ProSieben was the market leader again, ahead of RTL, with an audience share of 15.4 % (previous year: 16.0 %). SAT.1 closed 2014 with a market share of 9.2 % among 14 to 49 year olds (previous year: 9.4 %). In the relevant target group of 14 to 59 year old viewers, SAT.1 increased its market share by 0.1 percentage points to 9.6 %. kabel eins achieved a stable market share of 5.5 % in 2014 (previous year: 5.6 %).

sixx closed the 2014 financial year with a new record market share of 1.4 % among 14 to 49 year old viewers (previous year: 1.2 %). Its market share rose to 2.5 % in the relevant target group of women aged 14 to 39 — this represents a year-on-year increase of 0.4 percentage points. SAT.1 Gold generated a market share of 0.7 % of viewers aged 14 to 49 in 2014 (January 17, 2013 — December 31, 2013: 0.4 %). In the relevant target group of women aged 40 to 64, SAT.1 Gold gained 0.6 percentage points, increasing its market share to 1.2 % (January 17, 2013 — December 31, 2013: 0.6 %). ProSieben MAXX also increased its market share continuously in its first full year of broadcasting: In 2014, the men’s station broke through the 1 % threshold for the first time in the market for 14 to 49 year olds, closing the year with a market share of 1.0 % (September 3, 2013 — December 31, 2013: 0.6 %). In the relevant target group of 30 to 59 year old men, its market share grew to 0.9 % (September 3, 2013 — December 31, 2013: 0.6 %). ProSieben MAXX thus grew faster than any other third-generation broadcaster in a comparable period.

2014 was a successful year also for the Austrian station group ProSiebenSat.1 PULS 4: SAT.1 Österreich, ProSieben Austria, kabel eins austria, sixx Austria, SAT.1 Gold Österreich, ProSieben MAXX Austria and PULS 4 posted a combined market share of 21.9 % among viewers aged 12 to 49 (previous year: 21.2 %). ProSiebenSat.1 PULS 4 is thus 0.7 percentage points above the previous year’s figures and is still the strongest private station group in the Austrian TV market. The station PULS 4 once again made an important contribution to the increase in ratings: The station’s market share has been growing continuously since it started broadcasting seven years ago, both in the target group of 12 to 49 year olds and among viewers aged 12 years and over. With an annual market share of 4.1 % among 12 to 49 year old viewers and 3.6 % among viewers aged 12 years and over, PULS 4 is still number one among Austria’s private full service broadcasters.

In Switzerland, the stations SAT.1, ProSieben, kabel eins, sixx, SAT.1 Gold, and ProSieben MAXX achieved a combined market share of 17.3 % among viewers aged between 15 and 49 in the sports year 2014 (previous year: 17.8 %).

|

Audience shares of the ProSiebenSat.1 Group |

||||||||||||||||

|

|

|

|

|

|

||||||||||||

|

in percent |

Q4 2014 |

Q4 2013 |

2014 |

2013 |

||||||||||||

|

||||||||||||||||

|

Germany |

29.8 |

29.3 |

28.7 |

28.1 |

||||||||||||

|

Austria |

22.7 |

21.1 |

21.9 |

21.2 |

||||||||||||

|

Switzerland |

18.5 |

17.9 |

17.3 |

17.8 |

||||||||||||

Awards

In addition to the high market shares achieved by stations owned by the ProSiebenSat.1 Group in 2014, awards it received are an indicator of the popularity and quality of our formats as the following overview shows:

|

ProSiebenSat.1 program awards 2014 |

||||||

|

|

|

|

|

|||

|

ProSieben |

SAT.1 |

|||||

|

Bavarian TV Award |

„Got to Dance“ |

Bavarian TV Award |

“Got to Dance” |

|||

|

Grimme Award |

„CIRCUS HALLIGALLI“ |

Bavarian TV Award |

“Der Rücktritt” |

|||

|

ECHO |

Joko Winterscheidt und Klaas Heufer-Umlauf |

German Television Award |

“Danni Lowinski” |

|||

|

Rose d’Or |

„CIRCUS HALLIGALLI“ |

German Comedy Award |

“Pastewka” |

|||

|

German Television Award |

Joko Winterscheidt and Klaas Heufer-Umlauf |

German Comedy Award |

Annette Frier |

|||

|

German Comedy Award |

Christoph Maria Herbst |

BAMBI |

Josephine Preuß |

|||

|

Video Champions Creative Award |

„Pastewka” |

|

|

|||

|

European Science TV Award |

“Galileo Spezial: Showdown der Superbrains. Die zehn größten Genies der Weltgeschichte” |

|

|

|||

Development of User Numbers

With around 30 million unique users a month, SevenOne Media is one of the sales companies with the highest reach in Germany and ahead of its direct competitor IP Deutschland (around 27 million unique users). This finding is featured in a study by the Arbeitsgemeinschaft Online-Forschung (AGOF).

The online-portfolio of ProSiebenSat.1 includes strong brands like the websites of the TV stations, games portals or the entertainment platform MyVideo. The user numbers of the online offerings developed positively in 2014: With around 7.5 million unique users, the website ProSieben.de made it into the top 20 most-used online offerings in 2014. MyVideo registered around 11.3 million active users a month and thus remains number two among online video platforms in Germany; in terms of premium content, MyVideo continues to be the market leader. In addition to advertising-based websites, ProSiebenSat.1 operates the online video library maxdome. maxdome is Germany’s biggest video-on-demand portal and offers over 60,000 titles, which are available via TV, PC and laptop. Customers in Germany have also been able to access the content via mobiles since March 2014. In 2014, maxdome almost doubled its monthly subscriber numbers and increased its video views by around 150 %.

A year since it was founded, Studio71 has successfully established itself as the number two multi-channel network in Germany with more than 250 million video views a month. Last year, Studio71 benefited in particular from the partnership with Collective Digital Studio (CDS), one of the leading multi-channel networks in the USA. In 2014, ProSiebenSat.1 acquired a minority interest in the company. The development and marketing of shared formats is planned for the future.

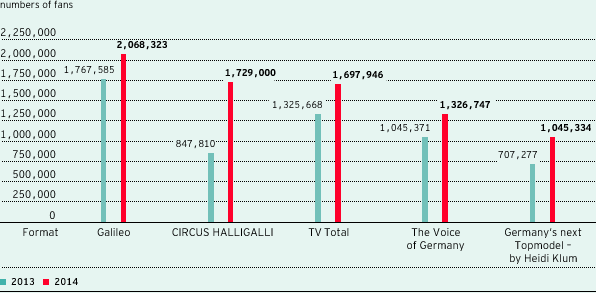

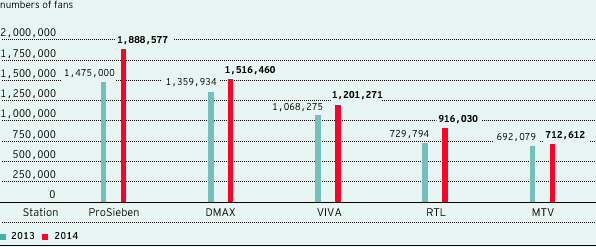

Moreover, ProSiebenSat.1 continued to develop well in the area of social media: At the end of the financial year, ProSiebenSat.1’s Facebook pages had a total of around 24 million fans (previous year: 16 million). The most successful pages were again the station and show pages of ProSieben and the science magazine “Galileo”. The ProSieben format “CIRCUS HALLIGALLI” recorded the biggest growth in its fan base: At the end of the year, the show had over 1.7 million Facebook fans, more than twice as many as in the previous year (2013: 847,810). In the “Social TV Buzz” ranking published by MediaCom, the show was in seventh place with 306,159 Facebook and Twitter posts, ahead of “Deutschland sucht den Superstar” (227,877 posts). A total of five ProSieben formats made it into the top 20 in the Social TV ranking in 2014.

ProSieben’s Twitter account became the first German media account to exceed one million followers in December, allowing ProSieben to emphasize its leading position in social media communications. No other TV station has used Twitter so successfully. By way of comparison, RTL’s Twitter account has just under 387,000 followers. Social media activities are an important viewer and user relationship tool for us.

Top 5 station websites in Germany on Facebook

Top 5 formats of the ProSiebenSat.1 Group on Facebook