Risk Report

Overall Assessment of the Risk Situation — Management View

Identifying and managing potential risks is just as important for a company as recognizing and taking opportunities. In order to deal with risks early and consistently, the ProSiebenSat.1 Group uses effective control systems. This also applies to opportunity management.

The media industry is subject to constant market change and intense competition. We are in a good strategic and operational position to benefit from the market’s dynamism and to use it as an opportunity to grow the TV business.

In 2014, we grew profitably in all segments and successfully continued the diversification of our value chain. However, our diversification strategy not only allowed us to realize additional growth potential in 2014, but also to increase our independence from the economically sensitive TV advertising market. At the same time, we have used the favorable capital market conditions to refinance our borrowings. This puts the Group on a sound operational and financial foundation.

Against this backdrop, as of the date of preparation of the Group management report, we consider risks to be limited, and the overall risk situation remains manageable. There has been no fundamental change in the overall risk situation compared with December 31, 2013. There are currently no discernible risks that, individually or in combination with other risks, could have a material or lasting adverse effect on the earnings, financial position and performance of the ProSiebenSat.1 Group over the projection period of two years.

Risk Management System

Risk is defined in this report as a potential future development or event that could significantly influence our business situation and result in a negative deviation from targets or forecasts. The risk indicators that we have already taken into account in our financial planning or in the consolidated financial statements as of December 31, 2014, do not therefore come under this definition and are consequently not explained in this Risk Report.

Clear decision-making structures, standardized guidelines, and a methodical approach are a fundamental requirement for secure risk handling across the Group. In view of the momentum of the media sector and the increasing diversity of the ProSiebenSat.1 Group’s business areas, processes and organization must be flexible enough to allow an appropriate response to new situations at all times.

The ProSiebenSat.1 Group has therefore established a standardized risk management system, which focuses on the Group’s specific circumstances. It simultaneously covers all activities, products, processes, departments, investments and subsidiaries that could have an impact on the Group’s business performance.

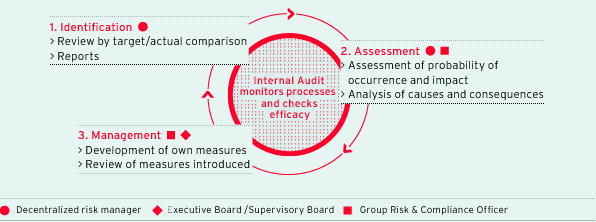

Risk management consists of the following steps:

- First of all, material risks are identified by means of a target/actual comparison. Those responsible for risk (decentralized risk managers) are guided by early warning indicators defined for all relevant circumstances and key figures.

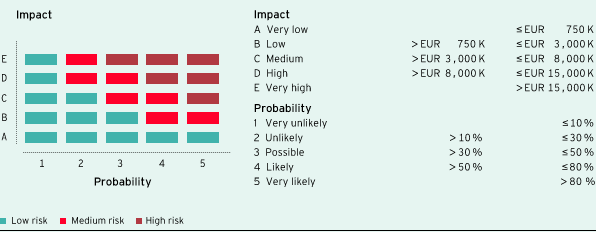

- The relevant risks are assessed on the basis of a three-step matrix: Firstly, the circumstances are assessed in terms of the probability of their occurrence. Secondly, their potential financial impact is estimated. By appraising the risks on the basis of these two dimensions, we can quantify them and classify their relative significance as “high,” “medium” or “low” in accordance with the figure below:

Risk classification

As well as classification, risk assessment also includes analyzing causes and interactions. Measures to counteract or minimize risks are included in the quantification (net assessment). In order to obtain the most precise view of the risk situation possible, however, opportunities are not taken into account. The latter are recorded in budget planning.

- The third and final step comprises risk management: As soon as an indicator reaches a certain tolerance limit, countermeasures are developed and implemented. The defined measures and risks are documented and tracked in reports throughout the year. The objective is to use appropriate measures to reduce the probability of occurrence or limit potential losses and thus add value in the long term.

Risk management process

The regular classification of risks occurs locally in the different corporate units: The responsible risk managers identify the risks according to the standard Group system described and document their results in an IT database every quarter. The Group Risk and Compliance Officer reports the risks identified there to the Executive Board and Supervisory Board. Relevant risks arising at short notice are reported immediately in addition to quarterly reporting. In this way, the Executive Board and Supervisory Board receive all decisive analyses and data at an early stage in order to respond proactively to emerging threats.

However, the Risk and Compliance Office not only supports the various corporate units in identifying risk at an early stage. It also ensures the efficacy and timeliness of the system by training the decentralized risk managers and continuously monitoring the scope of risk consolidation. Moreover, the Internal Audit unit regularly reviews the quality and compliance of the risk management system. It reports the results directly to the Group CFO.

The audit of the risk management system generated a positive result again in 2014. The system itself did not change in the past financial year. The basis for the audit is the Risk Management Manual. It summarizes company-specific principles and is based on the internationally recognized frameworks for enterprise risk management and internal control systems from COSO (Committee of Sponsoring Organizations of the Treadway Commission).

Development of Risk Clusters

Risk Categories and Overall Risk Situation

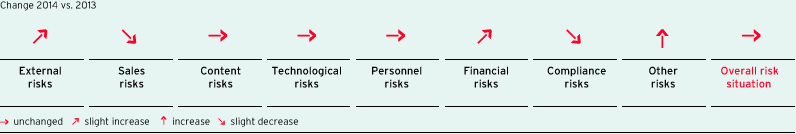

The assessment of the overall risk situation is the result of an aggregate analysis of the Group’s main risk clusters — “operating risks,” “financial risks,” “compliance risks,” and “other risks.” Due to their thematic diversity, we also subdivide operating risks into external risks, sales risks, content risks, personnel risks, and technological risks. To assess the overall risk situation, we classify the individual clusters on the basis of the above matrix and evaluate their changes in line with their potential probability or occurrence or impact on the Group’s overall risk situation.

Our overall risk situation remains limited. It is largely unchanged year-on-year, although some of the individual risk clusters have increased or decreased slightly compared to December 31, 2013:

Development of risk clusters and the overall risk situation of the Group as of December 31, 2014

Risk clusters that could materially impact our earnings, financial position and performance as from today’s perspective and their development compared to December 31, 2013 are outlined below. These are not necessarily the only risks that the Group faces. However, we are not currently aware of any additional risks that could impact our business activities, or we consider them as not material.

Operating Risks

|

Operating risks |

||

|

|

|

|

|

Key management measures |

External risks: Ongoing analysis of economic and industry trends, strategic brand positioning, diversification of the value chain |

|

|

|

Sales risks: Regular and systematic assessment of adverting revenues and market position, cost adjustments or changes in program planning and price policy, diversified customer base |

|

|

|

Content risks: Long-term relationships with licensors and close contact with producers, contractually securing exclusive rights, expansion of an in-house production unit |

|

|

|

Technological risks: Regular investments in the technological infrastructure and IT updates, back-up systems, systematic control |

|

|

|

Personnel risks: Strategic human resources recruitment and development, monitoring key figures |

|

|

|

Our experience in the media sector, clear organizational structures and qualified staff enable us to deal with operating risks appropriately and implement effective measures for risk reduction. We tackle operational challenges with systematic cost and efficiency controlling and ongoing market analysis, among other things. In addition, we optimize our risk profile by consistently investing in growth areas to reduce our dependency on individual markets and simultaneously leveraging digitalization as a growth opportunity for our TV and online business. |

|

External Risks

Macroeconomic risks. Our business activities are greatly dependent on the overall economic situation and especially on the development of the markets in which advertising customers operate. In recent years, private consumer spending, which constituted well over half the gross domestic product each year, has correlated particularly strongly to the German TV advertising market.

In the course of 2014, economic prospects for Germany initially continued to dim in view of global uncertainty factors, but growth prospects improved considerably toward the end of the year. Support came from the low price of oil and a weak euro, which was good for exports. Nevertheless, external risks such as the unstable situation in the eurozone remain high. Depending on duration and intensity, substantial negative effects from general economic conditions that could also directly or indirectly affect our revenue performance are currently a possibility. However, we still rate this development as a medium risk.

This is partly because, with stable labor market conditions, rising household incomes and low inflation, domestic private consumer spending looks set to continue developing positively in 2015. Growth forecasts for the German net TV advertising market predict a low single-digit percentage for 2015 and are similarly optimistic for 2016. At the same time, TV is likely to continue benefiting from future structural changes and increase its relevance as an advertising medium compared to print. High growth rates of close to 10 % are still expected for online advertising.

We analyze potential economic effects continuously and will in future also assess them systematically as part of risk management. In addition, we have defined strategic measures for the long-term optimization of our risk profile: A clear brand profile and reaching new target groups form the core of our multi-station strategy in the TV business. At the same time, we invest consistently in new growth markets like the distribution business, our online portals and e-commerce. We thus generate additional revenues and strengthen our independence from the economically sensitive free TV business. In 2014, the Group already generated 33.6 % of its revenues outside the TV advertising business — an increase of 5.0 percentage points year-on-year.

General industry risks (media usage behavior). With the emergence of digital media at the end of the 1990s, the assumption spread that traditional media such as television could experience a significant loss of importance. While print media are actually at high risk of being substituted as a result of digitalization, television remains the medium that is used most and its use time is holding steady at a high level.

According to a study by SevenOne Media GmbH, media consumption in 2014 climbed to around 670 minutes and reached a new record high at over 11 hours a day. The majority of the media consumption went on TV at nearly 40 % or around 4.5 hours a day, followed by radio at around two hours. Internet content is used for 86 minutes or nearly 1.5 hours a day. TV is also in the lead in terms of daily reach; TV achieves the highest daily reach of all traditional media not only among viewers aged 14 and up (82 %), but also in the younger segment of those surveyed between 14 and 49 years old at more than 74 %. Linear television continues to dominate: More than 95 % of usage time is currently attributable to linear watching on traditional TV sets. However, the main driver of rising media consumption is the internet. Two trends are emerging: The consumption of video content at any time and place is steadily increasing. At the same time, TV and online are increasingly being used together, especially by internet-minded “digital natives.”

SevenOne Media has been collecting data on the parallel use of TV and internet since as early as 2001. It increased only moderately in the early days and in the German TV market of the mid-2000s it leveled off at around a third of viewers aged between 14 and 49. The parallel use of TV and internet has only grown significantly since 2010 because of the growing pervasion of smartphones and tablets. In 2014, it was 75 % in the 14 to 49 year old target group, 58 % in the total population above 14. Particularly striking is the fact that parallel users surf the internet for 55 minutes longer and watch television for 50 more minutes per day. This shows that the internet is not replacing television, but rather acts as a multiplying factor. The conditions for integrating TV and internet are now present in nearly all German households, and the internet is firmly incorporated into people’s everyday lives. Over 80 % of those surveyed aged 14 and above now own one or more second-screen devices; 62 % of the German population aged 14 and above uses the internet every day. This figure is 82 % among 14 to 49 year olds.

The complementary interaction of TV and digital media can also be seen in advertising impact: 80 % of people who have seen a particular product on TV and then searched for it online have made a direct purchase on the internet. For each fourth person, this even happens frequently. This example shows how well TV advertising is complemented by the internet as a distribution and feedback channel. At the same time, television is the most stimulating medium with its high daily reach of 82 %.

Television is the number one medium in Germany – in both the audience and the advertising markets. TV is also very adaptable to digital media. ProSiebenSat.1 is therefore very well positioned to use the digital trend as a growth opportunity. At an early stage, the Group developed an innovative online offer, established maxdome as the leading online video portal in Germany, and built up an attractive e-commerce portfolio. By inference, we consider material risks from a change in media use to be unlikely to materialize. In the event of a fundamental change, however, we cannot completely rule out a significant financial impact on our core business and thus the entire Group. We therefore rate this as a medium risk overall.

Sales Risks

Media convergence. Technical developments — above all the digitalization of traditional media and the establishment of the internet — have caused media to converge in recent years. In the process, the once strong ties between content and end devices are coming undone: The same content is now used on various channels on different devices. For example, among 14 to 29 year olds around 10 % of TV usage is received via alternative methods such as live streams or TV sticks connected to PCs and laptops. This development is being driven by broadband internet connections with fast data transfer rates. The high market penetration of convergent devices entails both opportunities and risks for ProSiebenSat.1. While TV and online may be used more often in parallel and the consumption of video content on more and more new multimedia devices may rise, convergence could also lead to a future reduction in TV use. This could in turn have a negative impact on advertising customers’ willingness to invest and thus negatively affect prices for TV advertising.

Although we are not currently seeing substitution but rather increasing parallel use of TV and digital media, we believe it is possible that this risk may materialize. Therefore, we cannot rule out significant effects on our revenue or earnings performance. Accordingly, we classify potential losses from media convergence as a medium risk. For this reason, we will continue investing in the expansion of both our TV and digital businesses and making use of growth prospects offered by the integration of the two business areas.

Selling advertising time. In 2014, the ProSiebenSat.1 Group extended its lead in the German TV advertising market and moderately increased its prices for advertising space. The Group achieved adequate prices on the basis of attractive advertising concepts, program-related communication solutions and not least its high reach. Our customer base comprises companies from a wide range of industries. This diversified portfolio helps to compensate for declines in investment in individual sectors. In addition, the ProSiebenSat.1 Group is consistently developing its new customer business. New stations and innovative business models like the sale of free TV advertising space according to the media-for-revenue-share and media-for-equity principle are important growth measures in this context. In this way, the company frees up additional advertising budgets while making efficient use of its own programming and advertising inventory. The medium-term objective is to increase the share of TV advertising in the overall advertising market.

In the vast majority of cases, we do not conclude advertising contracts directly with the advertising companies. Instead, media agencies function as intermediaries, which become direct contract partners for our sales company SevenOne Media GmbH. The market for TV advertising time is characterized by concentrated structures both on the demand and supply side. On the demand side, there are essentially seven large associations of media agencies, which usually consist in turn of many smaller agencies. They are faced on the supply side primarily by the two private broadcasting groups, ProSiebenSat.1 and RTL, and the public television stations. Because of this and the high attractiveness of television and its relevance as the number one medium in the media mix, the business relationship formally concentrated on a few agencies does not give rise to any notable financial risk. Similarly, we have not identified any material default or liquidity risks because of the association structure described above and the short billing cycles of at most one month.

Should advertising budgets decline, the price level in the selling of advertising time fall or customers default, this could have significant consequences for the Group’s revenue and earnings performance. We rate this as a medium risk, but believe it is unlikely to materialize for the reasons given above. The advertising business is particularly sensitive to economic developments. In order to identify potential losses early, we analyze our advertising revenues and advertising market shares regularly. By comparing projections and actual figures with the corresponding prior-year values, budget deviations can be spotted and countermeasures such as cost adjustments or changes in program planning and price policy can be quickly implemented as well.

Online advertising: ad blockers. In connection with the sale of online advertising, the increasing prevalence of ad blockers represents a risk. These programs, often offered as browser plug-ins, prevent advertising from being displayed and therefore lead to considerable revenue losses in the online sector, which could increase if ad blockers become more widespread and thus result in a significant impact on the future success of the ProSiebenSat.1 Group. The ProSiebenSat.1 Group has taken various measures to limit this risk: The company is introducing technical means that can effectively prevent the ad blockers from functioning. We are also raising our users’ awareness with an education campaign called Stromberg-AdUcate. In addition, ProSiebenSat.1 has initiated legal steps and filed an application for an injunction against the operator of the most widespread ad blocker (AdBlock Plus) with the Munich Regional Court (Landgericht München I). However, further prevalence of ad blockers remains a possibility. Overall, we rate the total risk for the ProSiebenSat.1 Group as a medium risk.

Audience shares. Ratings are one of the most important indicators for early risk detection: They measure the reach of a show or an advertising spot and thus reflect how the programming offer meets the taste of the audience. They are therefore both a significant non-financial performance indicator in our internal management system and a means of documenting our performance for our advertising customers. To monitor risks, audience shares are therefore analyzed daily on the basis of data from the Working Group of Television Research (AGF). In this way, we are able to monitor the success of our formats extremely closely and if necessary to take countermeasures at any time. In addition to quantitative analyses, qualitative studies are also an important control instrument. Program research at ProSiebenSat.1 cooperates closely with various institutes on this. ProSiebenSat.1 commissions them to carry out regular telephone and online interviews and group discussions with viewers in Germany. In this way, stations obtain direct feedback from their audience and thus can optimize and further develop their programs on an ongoing basis.

Our station portfolio comprises complementary TV stations that address different core target groups and have specific programming profiles. Possible market share weaknesses at individual TV stations can thus be offset by the others. In the last few months, the comparatively new ProSiebenSat.1 stations have continuously increased both their technical reach and their audience market shares. At the same time, the major stations have performed positively following the soccer World Cup: ProSieben is the market leader in its relevant target group and made significant gains over RTL in 2014. SAT.1 is developing stably and extended its lead over rival VOX.

It can be assumed that established station brands like ProSieben and SAT.1 will continue to dominate the market due to their name recognition. The fragmentation of previous years was driven in particular by the opportunities of digital distribution. We are now seeing the first signs that the fragmentation is easing off.

Because of this development, the risk of a potential decline in audience market shares or the reach of advertising spots has decreased slightly in recent months. We believe it is unlikely that this risk will materialize. However, a decline in audience market shares could inherently make a substantial impact on our revenue and earnings performance. We therefore classify this as a medium risk.

Content Risks

Recognizable brands, high reach and interesting content are our competitive edge. This applies both to the TV business and to digital platforms: The ProSiebenSat.1 Group has an extensive portfolio of rights, because it works closely with more than 100 renowned licensors and has its own production arm, the Red Arrow Entertainment Group.

License purchases. Exclusivity and novelty are characteristics of the quality of interesting program formats. Therefore, the ProSiebenSat.1 Group uses exclusive agreements in the form of contractual blocking periods (hold-back clauses) to protect its rights against other licensees and program licensing forms. In order to stay informed about trends and new productions at an early stage, our purchasing department is also in constant dialog with national and international licensors. Nonetheless, we cannot completely rule out future risks from license purchases, but we consider them very unlikely. In this event, a moderate impact on our earnings performance would be conceivable. Overall, we classify this as a low risk. We base our assessment on the following issues and measures for the management of potential risks:

The ProSiebenSat.1 Group is exposed to currency risks when purchasing program licenses, because it acquires many of its feature films, TV movies, and series from the major US studios. The Group limits this risk with derivative financial instruments.

As well as exchange rate fluctuations, price increases could also influence license purchases and therefore our business performance. On the buying market, the ProSiebenSat.1 Group is in competition with other well-funded players – including the public stations. However, we have a strong negotiating position due to close business relationships with licensors and a high purchasing volume. In addition, programming contracts are often signed some years before production and broadcast; this secures our supply of programming in the long term. Nonetheless, the competition for attractive content could intensify further as a result of growing competition from international market participants and new digital offers. In addition, individual purchases are becoming a more frequent necessity, especially for small TV stations, as their programming is very specifically targeted. Moreover, signing programming contracts early does not have only advantages. It also harbors a certain potential risk with regard to future program formats if their quality and success is not as expected. In this event, it might be necessary to invest in additional programming. To proactively minimize this risk, we therefore only make long-term programming agreements with film studios and production companies with an appropriate reputation and successful track record. In any case, we have also identified a low potential loss in connection with the currently high proportion of US programs on our free TV stations. Series such as NAVY CIS and various sitcoms are hugely popular and achieve large audience shares in Germany. Nevertheless, the volume of such shows produced in the USA could decline in future and therefore no longer sufficiently cover demand. However, the ProSiebenSat.1 Group has a diversified supplier base and contracts with all major US studios.

Commissioned and in-house productions. Commissioned and in-house productions (local productions) can sometimes be produced more cheaply than purchased format and programming licenses. In addition, they are designed specifically for individual stations and thus strengthen the recognition value of a station. Because reference figures such as ratings are sometimes unavailable, the prospects for the success of local formats tend to be less certain than for licensed formats that have already been successful in other countries or in the movie theaters. The ProSiebenSat.1 Group therefore focuses on an individual and generally balanced mix of licensed programs as well as commissioned and in-house productions.

In order to assess the appeal of its in-house productions as reliably as possible, ProSiebenSat.1 conducts intensive market analysis. Researchers accompany the development of new program formats using a wide range of different methods, in many cases as early as the concept or screenplay stage. So-called Real-Time-Response tests (RTR) are a frequently used instrument. They are deployed when initial sequences or a pilot episode are available for new TV programs. When programs are screened, test persons document their response and reactions using a type of remote control, with accuracy down to the second and in real time. Another measure to limit risk is the internal format management process, whereby the program goes through several approval stages from development to implementation in order to ensure quality and success.

Although we believe it is unlikely that risks connected to local productions will materialize, we cannot completely rule out a medium negative impact on our revenue and earnings performance. Overall, we classify this risk as low.

Technological Risks

Ensuring uninterrupted transmission has high priority for the ProSiebenSat.1 Group. This also applies to system failures and data protection. In the light of extensive measures, we classify the two technological risks cited below as low overall, because their probability of occurrence and impact on the Group’s revenue and earnings performance are both rated as low.

Broadcasting equipment and studio operations. Damage to studio and broadcasting equipment can have financial consequences for our core business of TV: In the event of temporary failures or program changes at short notice, advertising customers could make guarantee and goodwill claims. We counter this risk with a comprehensive security plan. Back-up systems guarantee a broadcasting process without interruptions, even in cases of malfunction. The redundancy systems are kept at separate locations; if necessary with multifaceted protection and operable remotely. Ongoing maintenance and upgrades when needed keep the systems constantly state-of-the-art. In 2014, the basic infrastructure for the power supply at the Unterföhring location was also fully modernized.

The ProSiebenSat.1 Group has fully digitalized its transmission operations and transferred the content of the TV stations and online offerings to a shared platform. With its digital pool of materials, the Group has not only set the benchmark in the media industry, but has also leveraged time, quality, and cost advantages. The automation of technical processes reduces dependency on manual procedures and thus contributes to minimizing risk.

IT risks. The growing complexity of the system architecture presents the Group with various challenges: failures of systems, applications, or networks are as much potential risks as violations of data integrity and data confidentiality. The effectiveness of the security standards is therefore examined regularly by the Internal Audit department.

Drills of crisis scenarios help to simulate potential weaknesses and further improve the IT system. In order to prevent losses, the Group has multiple computer centers at separate locations, which assume each other’s tasks in the event of a system failure. The ProSiebenSat.1 Group also invests on an ongoing basis in hardware and software, in firewall systems and virus scanners, and establishes various access authorizations and controls. In 2014, the Group again subjected all relevant business applications to extensive tests, which confirmed a good degree of maturity.

As well as information technology incidents, unforeseeable events such as natural disasters could also have an adverse impact on production processes. Clear responsibilities and instructions are crucial, especially in an emergency. For this reason, the ProSiebenSat.1 Group has adopted a comprehensive safety guideline for dealing with emergencies and established a crisis management organization.

Personnel Risks

In the course of digitalization, the need for qualified specialists and managers is rising. Targeted appeals for applicants and close relationships with universities are crucial in the competition for talented employees, especially in our growth areas. For this reason, the Company implemented new programs and measures for recruitment and to fill vacant positions in 2014. The number of suitable applicants was considerably improved in terms of quantity and quality by means of increased standardization of the application procedure, a careers site optimized for mobile devices and target-group-specific events. Other components in our personnel management include skills development in accordance with requirements and a long-term performance and talent management system that, among other points, begins succession planning for key positions at an early stage. In recent years, the Group has continually expanded the in-house ProSiebenSat.1 Academy’s offerings and developed special support programs such as the Learning Expeditions. In addition, work-life-balance measures and attractive remuneration models generate long-term loyalty on our employees’ part and make ProSiebenSat.1 a preferred employer. This is reflected in HR figures such as the unchanged long average period of employment; in addition, the results of our employee survey and various external studies attest the attractiveness of the ProSiebenSat.1 Group as an employer.

Against this backdrop, we believe it is unlikely that personnel risks will occur, but cannot completely rule out a medium negative impact on our revenue and earnings performance. We continue to classify these risks as low.

Financial Risks

The ProSiebenSat.1 Group successfully refinanced its syndicated facility in 2014. In addition to extending maturities, the Group has lowered its borrowing costs and placed its overall financing structure on a broader basis with this transaction: The financial liabilities comprise a term loan and a revolving credit facility each with a five-year term and a bond with a term ending in 2021. The ProSiebenSat.1 Group therefore has a solid financial basis. However, the Group is exposed to various financial risks in its operating business and especially due to its borrowings. In addition, changes in exchange rates and liquidity shortages can have a negative impact on earnings, financial position and performance. Overall, we still regard the probability of occurrence of financial risks for the Group as very unlikely. However, we see slightly increased currency risk in light of the latest development on the foreign exchange markets and the weakness of the Euro.

Financial risks are assessed and managed centrally by the Group Finance & Treasury unit. The measures to manage or limit the risks are defined in close direct cooperation with the Executive Board. Principles, tasks, and responsibilities are defined on a Group-wide basis and regulated via binding guidelines for all subsidiaries of the ProSiebenSat.1 Group. The Finance & Treasury unit is audited annually by Internal Audit as part of risk management. The last audit again generated a positive result and confirmed the efficacy of the system.

Further information as per Section 315 (2) No. 2 German Commercial Code concerning financial instruments can be found in the Notes, Note 35 „Further notes on financial risk management and financial instruments according to IFRS 7“.

For more information on the hedging instruments, measurements and sensitivity analyses together with a detailed description of the risk management system in reference to financial instruments, refer to the notes to the consolidated financial statements.

Financing Risk. The Group monitors changes on the money and capital markets on an ongoing basis in order to ensure availability of and access to sufficient funds and the cost efficiency of the financial instruments used at all times. The availability of existing borrowing depends in particular on compliance with specific contractual conditions. The financial covenants of the facilities agreements were complied with once again in 2014; on the basis of our current corporate planning, a violation in the future is similarly not foreseen.

The syndicated facility includes standard market covenants, which are subject to regular assessment. Violations of the covenants could significantly impact our financial position and earnings performance, but we see this as very unlikely to occur. Therefore, we classify the financing risk as low overall.

Counterparty Risks. The Group concludes finance and treasury transactions exclusively with business partners which meet high credit rating requirements. The conclusion of finance and treasury transactions is regulated in internal counterparty guidelines. As well as assessing the credit standing of a counterparty and constantly monitoring counterparty risk, ProSiebenSat.1 limits the probability of occurrence of default risks through a broad diversification of its counterparties. Counterparty risks could have a considerable impact on our earnings performance and financial position. Due to the measures taken, we rate the probability of the occurrence of counterparty risks as very unlikely and the risk as low overall.

Interest rate swaps and foreign currency forward transactions are recognized in hedge accounting as cash flow hedges. More information can be found in the Notes, Note 35 „Further notes on financial risk management and financial instruments according to IFRS 7“. The ProSiebenSat.1 Group does not deploy derivative financial instruments for trading purposes, but only to hedge existing risk positions.

Interest Rate Risks. The ProSiebenSat.1 Group uses interest rate swaps and interest rate options to hedge its variable-interest loans against interest rate fluctuations caused by the market.

As of December 31, 2014, 95 % of the entire non-current financing portfolio was hedged with interest rate derivatives. To a minor degree, interest rate risks can also arise in connection with cash drawings on the revolving credit facility. However, as of December 31, 2014, there were no cash drawings on the RCF. In light of this, we believe interest rate risks are unlikely to materialize. However, if this risk does materialize, it could have at most a low negative impact on our earnings performance and financial position. Overall, we classify this as a low risk.

Currency Risks. Risks from currency fluctuations can arise if revenues are generated in a different currency from the related costs or capital expenditure (transaction risk). This is particularly relevant for license purchasing at ProSiebenSat.1: The Company concludes most of its license agreements with production studios in the United States and generally fulfills the financial obligations resulting from these in US dollars. The Group manages this risk by using derivative financial instruments, primarily currency forwards. As of December 31, the hedge ratio in terms of a seven-year period was 70 %. Because of the high hedge ratio, we rate the impact as medium. We believe it is unlikely that this risk will materialize. Overall, we therefore classify currency risks as low.

Liquidity Risks. Overall, we classify liquidity risks as low, but they could have significant financial consequences. Liquidity is therefore managed centrally through a cash management system. The most important early warning indicator is expected liquidity headroom. This is calculated and assessed regularly by comparing currently available funds and budgeted figures, taking into account seasonal influences. We assess Group liquidity as very good, and assume that the financial headroom will remain sufficient in the coming years. It is therefore very unlikely that this will give rise to risks.

|

Financial risks |

||

|

|

|

|

|

Key management measures |

Financing risks: Ongoing monitoring of financial covenants |

|

|

Counterparty risks: Broad basis of capital providers and strict credit rating checks |

||

|

|

Interest and currency risks: Targeted use of derivative financial instruments |

|

|

|

Liquidity risks: Securing solvency with a central cash management system and ongoing monitoring of liquidity headroom |

|

|

|

Interest and foreign exchange volatility or the default of lenders could considerably impair the financing situation and liquidity of the Group. We counter these risks with extensive measures, so we consider the overall probability of occurrence to be very unlikely. |

|

|

Disclosures on the internal controlling and risk management system in relation to the (consolidated) reporting process (section 315 (2) no. 5 of the German Commercial Code) with explanatory notes |

||||

|

|

||||

|

The internal controlling and risk management system in relation to the (consolidated) reporting process is intended to ensure that transactions are appropriately reflected in the consolidated financial statements of ProSiebenSat.1 Media AG (prepared in line with the International Financial Reporting Standards, IFRS) and that assets and liabilities are recognized, measured and presented appropriately. This presupposes Group compliance with legal and company regulations. The scope and focus of the implemented systems were defined by the Executive Board to meet the specific needs of the ProSiebenSat.1 Group. They are regularly reviewed and updated as necessary. Nevertheless, even appropriate and properly functioning systems cannot offer any absolute assurance that all risks will be identified and controlled. The company-specific principles and procedures to ensure that the Group’s single-entity and consolidated reporting is effective and correct are described below. |

||||

|

Goals of the risk management system in regard to financial reporting processes |

The Executive Board of ProSiebenSat.1 Media AG views the internal controlling system with regard to the financial reporting process as an important component of the Group-wide risk management system. Controls are implemented in order to provide an adequate assurance that in spite of the identified risks inherent in recognition, measurement and presentation, the single-entity and consolidated financial statements will be in full compliance with regulations. The principal goals of a risk management system in regard to single-entity and consolidated reporting processes are: |

|||

|

> |

To identify risks that might jeopardize the goal of providing single-entity and consolidated financial statements that comply with regulations. |

|||

|

> |

To limit risks that are already known by identifying and implementing appropriate countermeasures. |

|||

|

> |

To analyze known risks as to their potential influence on the single-entity and consolidated financial statements, and to take these risks duly into account. |

|||

|

In addition, in the reporting year we updated our process descriptions and our risk control matrices. The focus here was on standardizing the descriptions and establishing effective control mechanisms. These updates combined with regular tests on the basis of samples were part of the PRIME project. Since then, they have been an integrated part of the internal controlling and risk management system in relation to the (consolidated) reporting process. On the basis of the test results there is an assessment of whether the controls are appropriate and effective. Any deficiencies in the controls are eliminated, taking into account their potential impact. |

||||

|

Structural organization |

> |

The material single-entity financial statements that are incorporated into the consolidated financial statements are prepared using standardized software. |

||

|

|

> |

The single-entity financial statements are then consolidated to form the consolidated financial statements using modern, highly-efficient standardized software. |

||

|

|

> |

The financial statements of the main individual entities are prepared in compliance with both local financial reporting standards and the Group’s accounting and reporting manual based on IFRS, which is available via the Group intranet to all employees involved in the reporting process. The individual companies included in the consolidated financial statements provide their financial statements to Group Accounting in a defined format. |

||

|

|

> |

The financial systems employed are protected with appropriate access authorizations and controls (authorization concepts). |

||

|

|

> |

The entire Group has a standardized plan of accounting items, which must be followed in recording the various classes of transactions. |

||

|

|

> |

Certain matters relevant to reporting (e.g. expert opinions with regard to pension provision, measurement of the stock option plan, impairment testing of intangible assets) are determined with the assistance of external experts. |

||

|

|

> |

The principal functions of the reporting process — accounting and taxes, controlling, and finance and treasury — are clearly separated. Areas of responsibility are assigned without ambiguity. |

||

|

|

> |

The departments and other units involved in the reporting process are provided with adequate resources in terms of both quantity and quality. Regular professional training sessions are held to ensure that financial statements are prepared at a consistent and reliable level of quality. |

||

|

|

> |

An appropriate system of guidelines (e.g. accounting and reporting manual, intercompany transfer pricing guideline, purchasing guideline, travel expense guideline, etc.) has been set up and is updated as necessary. |

||

|

|

> |

The efficiency of the internal controlling system in regard to processes relevant to financial reporting is reviewed on a sample basis by the Internal Audit unit, which is independent of the process. |

||

|

Process organization |

> |

For the planning, monitoring, and optimization of the process of compiling the consolidated financial statements, there is a user-friendly web-based tool that includes a detailed calendar and all important activities, milestones, and responsibilities. All activities and milestones are assigned specific deadlines. Compliance with reporting duties and deadlines is monitored centrally by Group Accounting. |

||

|

|

> |

In all accounting-related processes, controls are implemented such as the separation of functions, the dual-control principle, approval and release procedures, and plausibility testing. |

||

|

|

> |

Tasks for the preparation of the consolidated financial statements are clearly assigned (e.g. reconciliation of intragroup balances, capital consolidation, monitoring of reporting deadlines and reporting quality with regard to the data of consolidated companies, etc.). Group Accounting is the central point of contact for specific technical questions and complex accounting issues. |

||

|

|

> |

All material information included in the consolidated financial statements is subjected to extensive systematic validation to ensure the data is complete and reliable. |

||

|

|

> |

Risks that relate to the (consolidated) accounting process are recorded and monitored continuously as part of the risk management process described in the Risk Report. |

||

Compliance Risks

Our business operations result not only in operating and financial risks, but also a wide range of legal risks. Results of legal disputes and cases can considerably damage our business, our reputation, and our brands as well as cause considerable costs. Ways we limit legal risks include cooperation with highly qualified legal experts and targeted staff training. The Group also establishes provisions for legal disputes if there is a present obligation arising from past events, it is probable that settlement will require an outflow of resources embodying economic benefits and the obligation can be measured reliably.

We classify the risks of individual legal and media policy changes or legal offenses differently, with regard to both their probability of occurrence and their potential financial consequences for the Group.

General Compliance

The objective of compliance is to ensure seamless management at all times and in all respects. Possible violations of legal statutory regulations and reporting obligations, infringements against the German Corporate Governance Code or insufficient transparency in corporate management can jeopardize conformity to the rules. It is for this reason that the ProSiebenSat.1 Group has established a Code of Compliance across the whole group, which provides employees with specific rules of conduct for various professional situations. Another effective measure to prevent possible compliance infringement is staff training on specific topics such as antitrust issues or the correct way to deal with insider information.

In order to prevent possible infringements, the ProSiebenSat.1 Group also implemented a Compliance Board constituted of legal experts, Internal Audit staff and employees of operating units. The task of the Compliance Board is to identify conceivable illegal actions at an early stage and initiate appropriate countermeasures. Another function of the Compliance Board is to introduce safeguards against possible external threats such as acts of sabotage. For a television group with a high level of public awareness, the issue of company protection is extremely important. For this reason, the ProSiebenSat.1 Group has taken various measures in order to realize comprehensive security of operating equipment. This includes state-of-the-art access control technology and qualified security staff.

The work of the Compliance Board is coordinated centrally by the Group Risk and Compliance Officer. His task is to keep abreast of legal developments and any changes in international legislation so as to be able to initiate suitable measures in due time. To bolster the Compliance organization, additional decentralized structures have been implemented. Regular exchanges of experience and information about current trends in different corporate areas have reduced the level of risk. The processes were analyzed by an independent consultant. The result of this risk assessment demonstrated that the Compliance processes in place are effective. In respect to implementing current antitrust law, ProSiebenSat.1 has been assessed as “best in class.”

In view of our effective compliance structures, we believe it is unlikely that this risk will occur, but cannot completely rule out a medium negative impact on the Group’s earnings performance. Accordingly, we classify the Group’s risk from general compliance as low.

Other Legal Risks

Regulatory risks. Any unforeseen changes to the legal and regulatory environment could have an impact on individual business activities. The ProSiebenSat.1 Group is exposed in particular to various risks in connection with tightened regulations, such as with regard to advertising, forms of advertising, broadcasting licenses or competitions. The ProSiebenSat.1 Group actively monitors all relevant developments and is in constant contact with the regulators concerned, to ensure that its interests are taken into account as far as possible. We rate the occurrence of risk from the regulatory or legal environment as unlikely and classify this risk as low overall. However, we cannot completely rule out a medium negative impact on our earnings performance, particularly in the Broadcasting German-speaking segment, if this risk nevertheless materializes.

Further information of legal disputes can be found in the Notes, Note 33 „Contingent liabilities“.

Claims for disclosure and actions for damages by RTL 2 Fernsehen GmbH & Co. KG and El Cartel Media GmbH & Co. KG. Claims for disclosure and action for damages by RTL 2 Fernsehen GmbH & Co. KG and El Cartel Media GmbH & Co. KG against SevenOne Media GmbH and the stations SAT.1 Satelliten Fernsehen GmbH, ProSieben Television GmbH, kabel eins Fernsehen GmbH and N24 Gesellschaft für Nachrichten und Zeitgeschehen mbH (no longer part of the Group) are pending at the Düsseldorf Regional Court since November 10, 2008. The plaintiff is asserting disclosure and damages claims in connection with the marketing of advertising time by SevenOne Media GmbH. On April 13, 2012, the Regional Court resolved to obtain an expert appraisal on the probability of loss. An expert has since been appointed. It is not yet known when the expert’s report will be submitted. The outcome of the case cannot currently be predicted. As a consequence, no provision was recognized as of the reporting date. We believe that this risk may possibly occur and have a medium negative impact on our earnings performance. We therefore classify this as a medium risk.

Section 32a German Copyright Act (“Bestseller”). Authors have made claims on the basis of Section 32a of the Copyright Act against companies of the ProSiebenSat.1 Group, in and out of court. The station group has since agreed so-called “Common Compensation Rules” with three organizations (directors, screenwriters and actors) under section 36 of the Copyright Act, which stipulate that additional compensation be paid to directors, screenwriters and actors if TV movies or series achieve certain ratings. For this issue, a provision of EUR 6.8 million was recognized as of December 31, 2014 (December 31, 2013: EUR 13.8 million). It is possible that third parties will make further justified claims under Section 32a of the Copyright Act that are not covered by the abovementioned “Common Compensation Rules.” Therefore it is still not possible to provide a reliable assessment of the impact on the earnings development primarily in the Broadcasting German-speaking segment, but also in the Digital & Adjacent segment. Overall, we therefore classify this as a medium risk.

Tax risks in connection with the disposal of subsidiaries in Sweden. The Swedish tax authorities completed the tax audit of a former Swedish branch of the ProSiebenSat.1 Group for the tax years 2008 to 2011 in December 2013 and for the tax years 2012 and 2013 in December 2014. As of December 31, 2014, therefore, all outstanding tax years of the former Swedish branch had been audited. In the judgment of the tax authorities, interest payments connected to the financing of shares in the former TV and radio companies of the SBS Group are not tax deductible in Sweden. The concluding reports of the two audits therefore earmark additional payments totaling approximately SEK 368 million (around EUR 39.2 million as of December 31, 2014). The ProSiebenSat.1 Group appealed against all the tax assessments within the deadline. In accordance with the request, a suspension of the enforcement of the assessments was granted in January 2014 (tax years 2008 to 2011) and in February 2015 (tax years 2012). In June 2014, first instance proceedings were brought before the Swedish Administrative Court regarding the tax years 2008 to 2011. On February 6, 2015, a verdict of first instance was issued in which the Administrative Court followed the legal opinion of the Swedish tax authorities. An appeal against this verdict is possible and currently in preparation. The second instance proceedings are expected to take 12 to 18 months. As things stand, a judicial dispute is also likely for the tax years 2012 and 2013.

The ProSiebenSat.1 Group continues to consider actual claims unlikely and is supported in this opinion by corresponding assessments of renowned Swedish tax and legal consultants. As a consequence, no provisions were recognized as of the reporting date. The probability of occurrence in the context risk management was rated as possible. Occurrence could have a high, one-off impact on our earnings performance up to the maximum amount stated above. Overall, we therefore classify this as a high risk.

Guarantees from the disposal of the Belgian TV activities. By sale and purchase agreement of April 20, 2011, the ProSiebenSat.1 Group sold its Belgian TV operations to De Vijver NV (“DV”). ProSiebenSat.1 Media AG acted to guarantee the disposal. On the basis of alleged infringements of the accounting and rental contract guarantee included in the purchase agreement, DV has asserted claims for damages against the company. The contractually agreed maximum liability from all guarantees totals EUR 19.8 million. On the basis of a further detailed review and the resulting reassessment of the factual and legal situation, we believe this risk is very unlikely to materialize and rate it as a low risk overall. In this respect, it is still unnecessary to recognize a provision. If the risk were nevertheless to materialize contrary to expectations, this could have a material one-off impact on our results up to the maximum amount of liability stated above.

Patent claims. The Kudelski Group claimed that certain business activities of the ProSiebenSat.1 Group infringed its patent rights. Back in the third quarter of 2014, the provision recognized for this was reversed on the basis of a further detailed review and the resulting reassessment of the factual and legal situation. The case was settled in the fourth quarter of 2014. The risk is therefore no longer relevant.

|

Compliance risks |

||

|

|

|

|

|

Key management measures |

General compliance risks: Group compliance structures and targeted training of employees |

|

|

|

Other legal risks: Close cooperation with legal experts |

|

|

|

We see different levels of impact for the potential financial consequences of individual legal and media policy changes as well as legal offenses, as the differences between compliance risks are in some cases considerable. |

|

Other Risks

Risks from Portfolio Measures (Incubation Business)

With media-for-equity and media-for-revenue-share, the Group has developed an attractive model to tap into new markets — without making major cash investments and therefore without high business risk. Alongside media-for-equity and media-for-revenue-share investments, the Group enlarges its portfolio with acquisitions. This also includes investing in start-ups provided they are a strategic fit and funding them could prove profitable. Strategically reviewing investments is therefore part of our active portfolio management. Against this backdrop, we analyzed our incubation business in Berlin and separated from certain investments in the reporting period. The incubator EPIC Companies GmbH is in liquidation. Selected investments were integrated into the Group.

The earnings effects resulting from these measures were reported in the Group’s income statement for 2014. We do not expect any more noteworthy negative effects in the 2015 financial year. We believe further deviations are unlikely; we rate the financial impact of these potential deviations as well as the overall risk as low.

Risks in Connection with the Sold Eastern European Operations

There are specific risks in connection with the disposal of the Eastern European TV operations: In connection with the sale of the Hungarian and Romanian operations, there are receivables from a purchase price and a working capital credit (Hungary) and a receivable from a deferred purchase price component (Romania) due from the buyers of the entities sold. The credits and purchase price receivable are subject to impairment risks in the event that the business operations do not generate sufficient cash funds. As of December 31, 2014, the net risk position with regard to the credits and purchase price receivables amounted to EUR 20 million. In addition, the ProSiebenSat.1 Group provided guarantees for various license agreements between the Hungarian and Romanian television stations and Universal Studios, CBS and Programs for Media totaling EUR 32.5 million. The ProSiebenSat.1 Group also granted a bridge loan of up to HUF 1.6 billion (EUR 5.1 million) for the Hungarian operations in early 2015. In the event of payment default, the ProSiebenSat.1 Group has corresponding liquidation rights to the Romanian and Hungarian shares in the amounts of 25 % and 100 % of the shares respectively. We believe the occurrence of the above risks is possible and cannot rule out a potential material effect on Group earnings up to the maximum of the amounts given above. Moreover, it is possible that the ProSiebenSat.1 Group will reconsolidate the Hungarian entities in the event of a default of payment of the guaranteed license fees, the loans or the purchase price receivable at the relevant maturity date. We classify the overall risk as high.