Company Outlook

Basis of the Forecast

According to the ifo Institute’s forecast, Germany remains on course for stable growth due to the ongoing positive consumer climate. This has positive effects on the German TV advertising market: In accordance with the market research institutes, we based our planning for 2015 on a net growth of the German advertising market of 2 % to 3 % and therefore expect to grow at least on market level.

In addition to the market growth, we include the high reach of TV into our economic considerations. The fragmentation of the media usage leads to an increasing value of television’s high reach for advertisers. We incorporate this competitive edge into our pricing. For this reason, we will increase our prices for TV advertising by a low to mid single-digit percentage in 2015. Hereby we also rely on a strong position in the audience market: In 2014, ProSiebenSat.1 further enhanced its market share compared to its main competitor. The German station family generated a combined market share of 28.7 % (previous year: 28.1 %) of viewers aged 14 to 49, despite the competitive environment of a sport year. We expect to at least maintain our leading position in the audience market in 2015.

In 2014, the ProSiebenSat.1 Group generated around 59 % of its revenues by selling TV advertising in Germany. The development on the German TV advertising market is therefore our most important planning assumption. In the Opportunity Report we report on the development of digital markets, which affects our business performance in the Digital & Adjacent segment in particular.

Expected Group and Segment Revenue and Earnings Performance

This Company Outlook only provides a qualitative/comparative forecast for the relevant key financial figures of the 2015 to 2016 projection period. The indicators “slight increase,” “mid single-digit increase,” “mid to high single-digit increase,” “high single-digit increase,” and “significant increase” are based on expected percentage deviations from the respective previous year.

We had a good start to the 2015 financial year in all segments and continue to benefit from a favorable economic climate. Our revenues in the core business of advertising-financed television and in our strategic growth areas are developing as planned, consequently we expect consolidated revenues to increase by a mid to high single-digit percentage in 2015. In the 2016 projection period, Group revenues are also likely to increase on the same level.

In the future, the Group will continue to invest in sustainable growth in all segments and diversify its revenue portfolio. The associated cost increase will be offset by additional disproportionately high growth in revenues; therefore we forecast EBITDA and recurring EBITDA to increase by a mid single-digit percentage in 2015 and 2016. Compared to the relevant European peer group companies, we are likely to continue achieving above-average margins. We expect underlying net income to grow by a high single-digit percentage in 2015 and 2016.

|

Forecast for Group key figures — 2-year view |

||||||||

|

|

|

|

||||||

|

EUR m |

2014 |

Forecasts1 2015/2016 |

||||||

|

||||||||

|

Revenues |

2,875.6 |

Mid to high single-digit increase |

||||||

|

EBITDA |

818.4 |

Mid single-digit increase |

||||||

|

Recurring EBITDA |

847.3 |

Mid single-digit increase |

||||||

|

Underlying net income |

418.9 |

High single-digit increase |

||||||

|

Leverage factor2 |

1.82 |

1.5 – 2.5 |

||||||

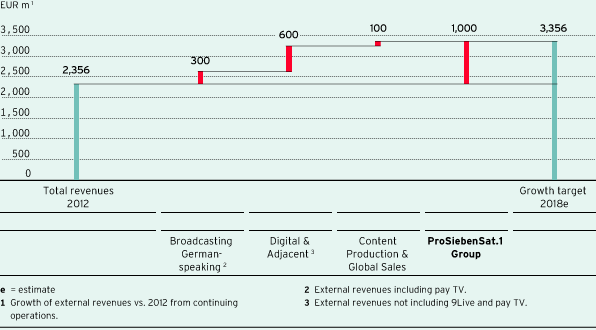

The Group has identified the biggest potentials in the interlinking of the high-reach TV offering and the dynamically growing digital industry. The Group is thus diversifying its business areas and tapping into new sources of revenues that are independent of the economically sensitive advertising market. In some cases, the expansion of the Digital & Adjacent activities and other growth areas was advanced more quickly than planned. At Group level, by 2018 we expect revenues to increase by EUR 1 billion compared with 2012. The operating margin of the additional revenues at Group level is expected to be 20 % to 25 % in 2018.

Revenue growth targets 2018

- Broadcasting German-speaking segment: In view of the positive start to the year, we expect a further increase of revenues in the German television market. Net prices for TV advertising are expected to continue growing. For 2015 and 2016, the Group plans to at least maintain or to slightly expand its leading position in the audience and TV advertising markets. In addition, with the distribution of its HD stations, the ProSiebenSat.1 Group has established another dynamically growing business area within its TV business. Against this backdrop, we expect to continue our profitable growth in the Broadcasting German-speaking segment and anticipate a further increase in revenues and recurring EBITDA in the next two years.

- Digital & Adjacent segment: In the Digital & Adjacent segment, the dynamic growth is likely to continue. For 2015 and 2016, we are again planning a significant increase in revenues and recurring EBITDA. We also expect a significant increase in EBITDA in the next two years. Due to diverging business models, the recurring EBITDA margins of the Digital & Adjacent segment are at around 20 %, as expected, slightly lower than in the core TV business. In the years to come, we aim to secure our leading competitive position in attractive digital entertainment markets and establish new verticals in the digital commerce sector. In addition, we will forge ahead with the internationalization of our digital business.

- Content Production & Global Sales segment: In the Content Production & Global Sales segment, we used acquisitions to become an established player in important TV markets such as the USA and the UK within previous years. In 2014, the Red Arrow Entertainment Group further strengthened its position in the US television market via a majority interest in the US production company Half Yard Productions. At the same time, the focus was on the consolidation of our investments and organic growth. In the financial year 2015, Red Arrow wants to strengthen its presence in the English-speaking markets via the existing subsidiaries and promote business with successful digital companies. Revenues and recurring EBITDA are expected to achieve a mid to high single-digit increase in the next two years.

|

Forecast for segment key figures — 2-year view |

||||||||||

|

|

|

|

|

|

||||||

|

|

2014 |

Forecasts1 2015/2016 |

||||||||

|

EUR m |

External revenues |

Recurring EBITDA |

External revenues |

Recurring EBITDA |

||||||

|

||||||||||

|

Broadcasting German-speaking |

2,062.7 |

702.8 |

Slight increase |

Slight increase |

||||||

|

Digital & Adjacent |

610.7 |

129.3 |

Significant increase |

Significant increase |

||||||

|

Content Production & Global Sales |

202.2 |

19.1 |

Mid to high single-digit increase |

Mid to high single-digit increase |

||||||

Future Financial Position and Performance

ProSiebenSat.1 lets its shareholders participate in the Company’s success appropriately. We intend to continue our current earnings-oriented dividend policy and distribute an annual dividend of 80 % to 90 % of underlying net income. For 2014, we will propose a dividend of EUR 1.60 per common share (previous year: EUR 1.47). This represents an expected payout of EUR 342 million or 81.6 % of underlying net income. This results in an attractive dividend yield of 4.6 % (previous year: 4.1 %) compared to the closing price at the end of 2014.

The ProSiebenSat.1 Group’s objective is to participate in the growth of dynamic markets and to establish its own brands there at an early stage. The Company will therefore continue to use its free cash flow also for strategic growth investments. In recent years, the ProSiebenSat.1 Group has expanded its portfolio primarily through smaller acquisitions or media-for-equity respectively media-for-revenue-share partnerships without large cash investments. In the future, the Group will also examine opportunities for growth through larger bolt-on acquisitions in the Digital & Adjacent segment alone or together with partners, if they fit from a strategic viewpoint and contribute to the growth of the whole Group.

The expected operating performance is also likely to have a positive impact on our liquidity level and our free cash flow before M&A activities. In the future, the largest part of our investments with about EUR 900 million will continue to be made into the programming assets of the Broadcasting German-speaking segment. At the same time, the Group will adhere to the targeted leverage factor of 1.5 to 2.5.

As of December 31, 2014, the Group was in a sound financial position with an equity ratio of 19.3 % and had an efficient financial structure with a leverage factor of 1.8. Through the placement of notes and the new facilities agreement, the Group has recently further optimized its financing and placed it on a broader basis at attractive conditions. At the same time, the ProSiebenSat.1 Group extended and diversified its maturity profile. Thanks to these measures, the Group also expects financing costs and cash flow (before taxes) to improve by approximately EUR 50 million over a period of four years.