Future Business and Industry Environment

In 2014, the German economy grew by 1.5 % and performed soundly in comparison to the rest of the world. Accordingly, the forecasts for 2015 are positive: While the slump in oil prices is sustaining the domestic economy, the weak euro is benefiting exporters. In addition, monetary policy remains expansionary. Domestic private consumption is also likely to make significant contributions to growth again, with favorable labor market conditions, rising real incomes, low inflation and low interest rates. In Germany, private consumption is the most important macroeconomic expenditure component with a share in GDP of roughly 55 %. Against this backdrop, leading economic research institutes expect real GDP to increase by around 1.5 %. In its latest annual projection from January, the German government also forecasts real GDP growth of 1.5 %. Back in October, it predicted growth of 1.3 % for this year.

On the other hand, economic experts see external economic risks: These include the economic situation in China, Russia and Japan and a potential overheating of stock and property markets, especially in China. There are also ongoing structural problems in the euro zone and modest export prospects in important emerging countries, which could inhibit companies’ already limited willingness to invest. Negative effects could also be generated by geopolitical risks. Accordingly, the International Monetary Fund (IMF) expects the global economy to grow by 3.5 % in 2015. For the euro zone, the IMF anticipates growth of 1.2 % compared to 2014.

The development of advertising markets is closely related to the current and expected general economic situation: If the economy develops positively, companies and consumers are more willing to invest additional money in advertising or consumption than in economically weak phases. This was demonstrated again in 2014: Positive economic development promoted advertising industry investment in Germany. For this purpose the Association of German Advertisers (Zentralverband der deutschen Werbewirtschaft, ZAW) will publish final figures in May 2015. According to forecasts, the net growth of the TV advertising market is expected to have increased by about 3 % (Zenith: +3.3 %, WARC: +2.9 %, PwC: +3.0 %).

Forecasts are also confident for 2015; the German TV market will again grow (Zenith: +2.8 %, WARC: +1.9 %). In addition to supportive economic effects, television is also set to continue benefiting from the fact that with digitalization print becomes significantly less important. In contrast, TV remains the most important mass medium and is continuously increasing its relevance as an advertising medium. This structural change is likely to continue in the years to come.

Furthermore, due to structural characteristics, linear TV in Germany is under less pressure. In contrast to the USA or Scandinavian countries, Germany is less fragmented, characterized by fewer commercial breaks, and on average the shows are of higher quality. In addition, despite the diverse digital offerings, linear television still dominates in Germany; more than 95 % of usage time is currently attributable to watching on traditional TV sets. Among other reasons, this is because the penetration of smart TVs, the expansion of broadband internet and digital affinity are not yet as advanced in Germany as in the USA, Great Britain or Scandinavia.

Nonetheless, the main driver of rising media consumption in this country remains the internet. Thereby, TV and digital media complement each other. Against this backdrop, the prospects for digital media are similarly positive: In-stream video advertising is likely to develop particularly dynamically and drive growth. Video-on-demand will also continue its significant growth; the market volume is expected to climb by 20 % to 40 % every year until 2018. Digital commerce also promises double-digit growth rates in the medium term, as more and more products and services are being purchased online. Digitalization means that not only media consumption but also many other areas of our lives are increasingly shifting onto the internet. This forms a strong basis for the growth of our digital entertainment and digital commerce offers.

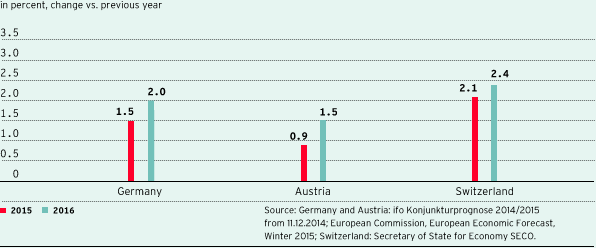

Forecasts for real gross domestic product in countries important for ProSiebenSat.1

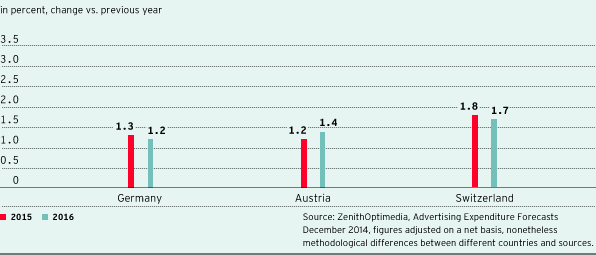

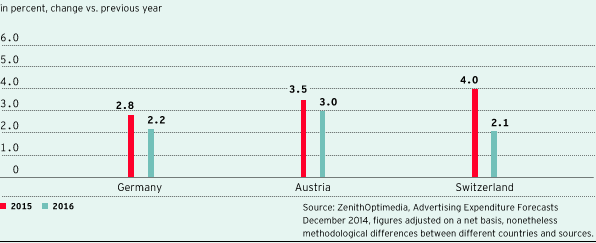

Forecast development of the TV advertising market in countries important for ProSiebenSat.1

Forecast development of the overall advertising market in countries important for ProSiebenSat.1