Group Earnings

The analysis of the revenue and earnings performance in 2014 relates to the continuing operations of the ProSiebenSat.1 Group, unless otherwise indicated.

In 2014, the ProSiebenSat.1 Group increased its consolidated revenues to a new record high. On the basis of the considerable revenue growth, the performance indicators also reached new records, as shown by the multi-year comparison below:

|

Multi-year comparison of revenue and earnings performance |

||||||

|

|

|

|

|

|||

|

EUR m |

2014 |

2013 |

2012 |

|||

|

Revenues |

2,875.6 |

2,605.3 |

2,356.2 |

|||

|

EBITDA |

818.4 |

757.8 |

680.4 |

|||

|

Recurring EBITDA |

847.3 |

790.3 |

744.8 |

|||

|

Underlying net income |

418.9 |

379.7 |

355.5 |

|||

Compared to 2013, Group revenues increased by 10.4 % or EUR 270.4 million to EUR 2.876 billion. All segments contributed to this:

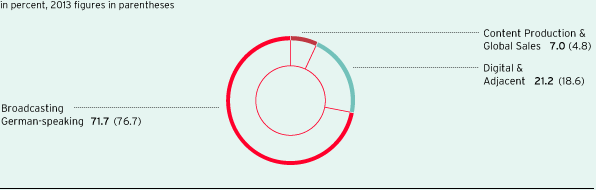

- The Broadcasting German-speaking segment with the core business of advertising-financed television achieved revenue growth of EUR 64.9 million to EUR 2.063 billion. This corresponds to a share in consolidated revenues of 71.7 % (previous year: 76.7 %).

- The Digital & Adjacent segment increased its revenues by EUR 127.0 million to EUR 610.7 million, again contributing the highest amount of growth. The segment grew organically, while at the same time acquisitions led to revenue growth.

- The Content Production & Global Sales segment also grew dynamically. It generated revenues of EUR 202.2 million (previous year: EUR 123.8 million). The positive revenue development was largely based on organic growth.

The ProSiebenSat.1 Group thus further increased the share of the two segments Digital & Adjacent and Content Production & Global Sales in consolidated revenues; they contributed 28.3 % or EUR 812.9 million (previous year: EUR 607.5 million). The Group’s target is to diversify the portfolio in order to grow with less dependence on the economically sensitive TV advertising market.

Group revenue share by segment

Other operating income amounted to EUR 27.9 million after EUR 25.4 million in the comparative period (+9.6 %). Alongside diverse income relating to other periods and recharges, the income from the deconsolidation of Magic Internet Musik GmbH in August 2014 had a positive effect on the development of the other operating income.

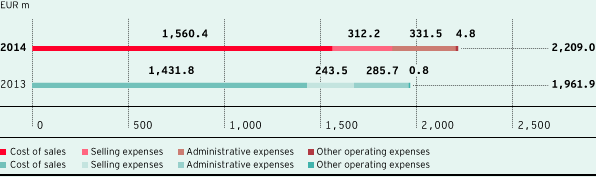

The ProSiebenSat.1 Group invests in all segments into markets with long-term prospects for growth and synergies. As a result, total costs have increased. They totaled EUR 2.209 billion, an increase of 12.6 % or EUR 247.1 million compared to 2013. Total costs comprise cost of sales, selling expenses, administrative expenses and other operating expenses.

- The majority of the cost increase can be attributed to higher cost of sales. These increased because of growth in all segments, where there was primarily a rise in programming and material expenses. This also includes the consumption of programming assets — the Group’s largest cost item — at EUR 867.8 million (previous year: EUR 858.7 million). In addition to higher programming and material expenses, acquisitions in particular caused an increase in cost of sales. In total, cost of sales rose by 9.0 % or EUR 128.6 million to EUR 1.560 billion.

- In 2014, selling expenses increased by 28.2 % or EUR 68.7 million to EUR 312.2 million. The increase especially reflects the higher business volume in the Digital & Adjacent segment. In addition to an organic cost increase, a major portion is attributable to the consolidation of COMVEL GmbH, operator of the travel sites weg.de and ferien.de, since January 2014. In addition, costs relating to video-on-demand and online advertising grew proportionately to revenues. As a result of higher revenues, the Broadcasting German-speaking segment also showed a cost increase. One reason for this was higher personnel and distribution costs as part of the expansion of the TV portfolio.

- The Group’s administrative expenses amounted to EUR 331.5 million (previous year: EUR 285.7 million). This 16.0 % increase mainly resulted from higher personnel expenses. These rose primarily due to acquisitions; another factor was the provision for the special performance based payment to ProSiebenSat.1 employees. In total, the personnel expenses included in cost of sales, selling expenses and administrative expenses increased by 22.0 % to EUR 391.7 million (previous year: EUR 321.0 million).

- Other operating expenses increased by EUR 4.0 million to EUR 4.8 million (previous year: EUR 0.8 million). The growth is primarily due to losses from the disposal of smaller affiliated companies as well as property, plant and equipment and intangible assets.

Total costs

The depreciation and amortization reported in total costs increased, partly because of acquisitions, and amounted to EUR 123.8 million, an increase of 39.3 % or EUR 34.9 million. EUR 19.9 million was attributable to intangible assets from purchase price allocations; in the previous year, these amounted to EUR 8.0 million. The scheduled amortization from purchase price allocations is mostly included in the administrative expenses.

Operating costs adjusted for depreciation, amortization and non-recurring expenses amounted to EUR 2.047 billion (previous year: EUR 1.836 billion). This equates to an increase of 11.5 % compared to 2013. The table below shows a reconciliation of operating costs:

|

Reconciliation of operating costs |

||||||

|

|

|

|

||||

|

EUR m |

2014 |

2013 |

||||

|

||||||

|

Total costs |

2,209.0 |

1,961.9 |

||||

|

Non-recurring expenses |

-38.2 |

-37.1 |

||||

|

Depreciation/amortization1 |

-123.8 |

-88.9 |

||||

|

Operating costs |

2,046.9 |

1,835.8 |

||||

EBITDA increased by 8.0 % compared to 2013 to EUR 818.4 million (previous year: EUR 757.8 million). It includes non-recurring items of EUR 28.9 million (previous year: EUR 32.6 million), which are largely the result of the bundling of games activities in Berlin. Further non-recurring expenses result from portfolio optimizations in 2014 concerning the liquidation of the Belgian and Dutch production companies. After the sale of the international TV and radio portfolio in 2011, the Company will dissolve its production companies in Belgium and the Netherlands. Overall, portfolio measures led to non-recurring expenses of EUR 13.9 million. Additionally, EUR 7.9 million are the result of severance payment.

After elimination of non-recurring effects, recurring EBITDA amounted to EUR 847.3 million. This equates to a growth of 7.2 % or EUR 57.0 million. At 29.5 % (previous year: 30.3 %), the recurring EBITDA margin reflects the ProSiebenSat.1 Group’s high level of profitability. As planned, the Company increased the share of the Digital & Adjacent segment in the Group’s recurring EBITDA compared with the previous year.

|

Reconciliation of recurring EBITDA from continuing operations |

||||||||

|

|

|

|

||||||

|

EUR m |

2014 |

2013 |

||||||

|

||||||||

|

Profit before income taxes |

560.1 |

526.9 |

||||||

|

Financial result |

-134.4 |

-142.0 |

||||||

|

EBIT |

694.5 |

668.9 |

||||||

|

Depreciation/amortization1 |

123.8 |

88.9 |

||||||

|

thereof from purchase price allocations |

19.9 |

8.0 |

||||||

|

EBITDA |

818.4 |

757.8 |

||||||

|

Non-recurring items2 |

28.9 |

32.6 |

||||||

|

Recurring EBITDA |

847.3 |

790.3 |

||||||

The financial result also continued to improve compared to 2013. It amounted to minus EUR 134.4 million after minus EUR 142.0 million in the previous year. This development is characterized by contrary effects:

- Main driver for the improvement of the financial result by 5.3% or EUR 7.6 million were considerably lower interest expenses. They decreased by 24.8 % or EUR 33.5 million to EUR 101.5 million. In April 2014, the Group repaid a portion of its loans early and simultaneously refinanced the remaining loans and borrowings. As a result, ProSiebenSat.1 is now benefiting from more favorable conditions.

- The improvement was offset by changes in the other financial result. In the financial year 2014, the other financial result amounted to minus EUR 39.4 million (previous year: EUR -18.6 million). This position contains firstly impairments on financial investments of EUR 30.3 million (previous year: EUR 24.1 million). These related to impairments on the shares in ZeniMax Media Inc. of EUR 7.3 million (previous year: EUR 12.4 million), among others. Secondly, the other financial results includes one-off expenses in the amount of EUR 15.3 million related to the refinancing measures (previous year: EUR 7.2 million). In this context, the Group also dissolved hedges, which resulted in expenses of EUR 6.3 million. However, the fair-value measurement of earn-out provisions and put options in the amount of EUR 10.8 million (previous year: EUR 15.5 million) on the reporting date had a positive effect on the other financial result.

- Result from investments accounted for using the equity method fell to EUR 2.9 million in the same period (previous year: EUR 5.1 million).

The developments described resulted in an increase of earnings before taxes of 6.3 % or EUR 33.2 million to EUR 560.1 million. After taxes, the net profit for the period amounted to EUR 381.5 million, an increase of 4.6 % or EUR 16.8 million. Income taxes amounted to EUR 178.6 million (previous year: EUR 162.2 million); the tax rate was 31.9 % (previous year: 30.8 %). The higher tax rate for 2014 was primarily due to taxes relating to other periods that were realized in the fourth quarter of 2014.

At the same time, underlying net income grew by 10.3 % to EUR 418.9 million (previous year: EUR 379.7 million); the corresponding basic underlying earnings per share rose to EUR 1.96 (previous year: EUR 1.78). Underlying net income is adjusted for the following effects:

|

Reconciliation of underlying net income from continuing operations |

||||||

|

|

|

|

||||

|

EUR m |

2014 |

2013 |

||||

|

||||||

|

Consolidated net profit (after non-controlling interests) |

373.5 |

359.5 |

||||

|

Amortization from purchase price allocations (after tax)1 |

13.4 |

5.4 |

||||

|

Impairment of shares in ZeniMax Media Inc. |

7.3 |

12.4 |

||||

|

Release of deferred financing costs |

5.4 |

-/- |

||||

|

Impairments on other financial investments |

19.5 |

2.4 |

||||

|

Underlying net income |

418.9 |

379.7 |

||||

The result after taxes from discontinued operations amounted to minus EUR 27.1 million. This figure includes the operating earnings contribution of the Eastern European operations until their deconsolidation as well as the result from the deconsolidation of these companies of minus EUR 14.0 million (previous year: EUR 77.0 million). In addition impairments and allocations to provisions of EUR 18.6 million in total were recorded in 2014. For the comparative period, earnings from discontinued operations amounted to minus EUR 47.6 million. As well as the operating earnings contributions from the Eastern European business, the comparatively high figure for the previous year also includes the results from the activities in Northern Europe and its respective deconsolidation effects. The Northern European portfolio was deconsolidated in April 2013.

The reconciliations below give an overview of selected key figures in the income statement, taking into account the activities sold and deconsolidated. Further information on the deconsolidated activities can be found in the notes.

|

Selected key figures of the ProSiebenSat.1 Group for the 2014 financial year |

||||||||||||

|

|

|

|

|

|

|

|

||||||

|

|

ProSiebenSat.1 including discontinued operations |

Discontinued operations |

ProSiebenSat.1 continuing operations |

|||||||||

|

EUR m |

2014 |

2013 |

2014 |

2013 |

2014 |

2013 |

||||||

|

Revenues |

2,888.0 |

2,818.1 |

12.3 |

212.8 |

2,875.6 |

2,605.3 |

||||||

|

Operating costs1 |

2,060.2 |

2,142.5 |

13.2 |

306.6 |

2,046.9 |

1,835.8 |

||||||

|

Total costs |

2,243.2 |

2,311.2 |

34.2 |

349.3 |

2,209.0 |

1,961.9 |

||||||

|

Cost of sales |

1,570.6 |

1,680.0 |

10.2 |

248.2 |

1,560.4 |

1,431.8 |

||||||

|

Selling expenses |

315.8 |

289.3 |

3.6 |

45.7 |

312.2 |

243.5 |

||||||

|

Administrative expenses |

339.9 |

331.9 |

8.4 |

46.2 |

331.5 |

285.7 |

||||||

|

Other operating expenses |

16.9 |

10.0 |

12.0 |

9.2 |

4.8 |

0.8 |

||||||

|

EBIT |

672.9 |

610.0 |

-21.6 |

-58.9 |

694.5 |

668.9 |

||||||

|

Recurring EBITDA2 |

846.7 |

696.8 |

-0.6 |

-93.5 |

847.3 |

790.3 |

||||||

|

Non-recurring items3 |

-49.9 |

37.2 |

-20.9 |

69.8 |

-28.9 |

-32.6 |

||||||

|

EBITDA |

796.8 |

734.1 |

-21.6 |

-23.7 |

818.4 |

757.8 |

||||||

|

Consolidated net profit attributable to shareholders of ProSiebenSat.1 Media AG |

346.3 |

312.1 |

-27.1 |

-47.3 |

373.5 |

359.5 |

||||||

|

Underlying net income4 |

391.8 |

340.1 |

-27.1 |

-39.6 |

418.9 |

379.7 |

||||||

|

Selected key figures of the ProSiebenSat.1 Group for the fourth quarter of 2014 |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

ProSiebenSat.1 including discontinued operations |

Discontinued operations |

ProSiebenSat.1 continuing operations |

|||||||||||||||||||

|

EUR m |

Q4 2014 |

Q4 2013 |

Q4 2014 |

Q4 2013 |

Q4 2014 |

Q4 2013 |

||||||||||||||||

|

||||||||||||||||||||||

|

Revenues |

965.9 |

865.0 |

-/- |

24.2 |

965.9 |

840.8 |

||||||||||||||||

|

Operating costs1 |

645.6 |

647.7 |

-/- |

100.3 |

645.6 |

547.3 |

||||||||||||||||

|

Total costs |

699.9 |

715.9 |

5.6 |

128.0 |

694.2 |

587.9 |

||||||||||||||||

|

Cost of sales |

490.8 |

520.2 |

-/- |

97.9 |

490.8 |

422.3 |

||||||||||||||||

|

Selling expenses |

99.8 |

89.4 |

0.0 |

5.2 |

99.8 |

84.2 |

||||||||||||||||

|

Administrative expenses |

106.7 |

102.8 |

4.9 |

21.9 |

101.8 |

80.9 |

||||||||||||||||

|

Other operating expenses |

2.5 |

3.5 |

0.8 |

3.0 |

1.8 |

0.5 |

||||||||||||||||

|

EBIT |

276.2 |

158.8 |

-5.6 |

-103.3 |

281.8 |

262.1 |

||||||||||||||||

|

Recurring EBITDA2 |

325.1 |

226.2 |

-/- |

-75.9 |

325.1 |

302.1 |

||||||||||||||||

|

Non-recurring items3 |

-13.9 |

-18.5 |

-5.6 |

-5.1 |

-8.2 |

-13.4 |

||||||||||||||||

|

EBITDA |

311.2 |

207.7 |

-5.6 |

-81.0 |

316.9 |

288.7 |

||||||||||||||||

|

Consolidated net profit attributable to shareholders of ProSiebenSat.1 Media AG |

149.4 |

59.4 |

-18.4 |

-95.6 |

167.8 |

155.0 |

||||||||||||||||

|

Underlying net income4 |

162.0 |

65.7 |

-18.4 |

-93.1 |

180.4 |

158.9 |

||||||||||||||||