Opportunity Report

In an organizational way we have created all conditions to guarantee that the risk situation is presented and handled transparently, that potential losses are limited and that action is taken early. The ProSiebenSat.1 Group has also implemented effective processes for the identification and management of opportunities.

In the ProSiebenSat.1 Group, the management of opportunities is centrally organized and controlled by the “Strategy & Operations” department. The department is in close contact with the individual operational units and their managers, so it gains a detailed insight into the business situation. In addition, external studies and the exchange of knowledge with external experts serve as important sources for analyzing the market and competitive situation and identifying growth potential for the ProSiebenSat.1 Group.

The defined opportunities are summarized in the strategy plan and incorporated into the decision-making process during the annual strategy meeting. Relevant opportunities are prioritized, specific objectives are derived, and measures and resources for operational target attainment are determined.

Opportunity management is part of the intragroup management system. It is linked to the budget preparation process and is included in both the twelve-month and the multi-year plan. We have already incorporated growth opportunities in our targets for 2015 or in our medium-term planning for 2018 whose probability of occurrence we consider very high. Further information is available in the Company Outlook. There are also opportunities that have not yet been budgeted for and could consequently result in a positive deviation from forecasts or targets. We report on this additional growth potential below. In particular, this potential can arise from a change in general conditions or our market shares. Strategic decisions can also promote additional growth that has not yet or not yet fully been budgeted for.

|

Overview changes and potentials |

||||||||

|

|

|

|

|

|

||||

|

|

Budgeted growth potential |

Additional opportunities |

||||||

|

Development of general conditions |

> |

Video is the driver of growing internet use and the basis for TV’s high popularity |

> |

General conditions or market shares change more rapidly or more favorably than expected |

||||

|

|

> |

TV is complemented synergistically by online media, growing distribution of paid-content models like video-on-demand (VoD) |

|

|

||||

|

|

> |

HD use grows dynamically |

|

|

||||

|

Corporate strategy decisions |

> |

Value creation through diversification and especially digitalization and expansion of the e-commerce business |

> |

Bolt-on acquisitions alone or with strategic partners |

||||

|

|

> |

Tapping into new markets with portfolio measures and internationalization of media-for-revenue-share and media-for-equity (M4R/M4E) portfolios |

> |

Expansion of the station family |

||||

Development of General Conditions

Macroeconomic factors have a major influence on the advertising industry’s investment behavior: Low unemployment rates and rising real incomes create positive stimuli in private consumption. In turn, these factors can support the advertising industry’s willingness to invest, boost the price level and thus accelerate our Group’s revenue growth. Our budgets for 2015 are based on the German TV advertising market growing by a low single-digit percentage. As our target attainment correlates closely with the development of the TV advertising market, a positive deviation from this important planning assumption could potentially accelerate our growth significantly.

In addition to this macroeconomic and structural data, audience ratings could also exceed the figures budgeted internally and raise the price level for advertising space in the medium term. With regard to the reach of our German station portfolio, we expect at least stable development of the audience share in 2015 as a whole.

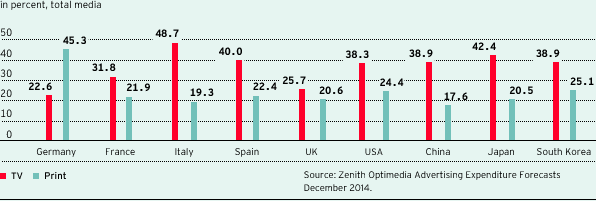

Market share international TV vs. Print 2014

Besides the stable economic development, the structural shift toward video content promotes the growth of the German TV advertising market. The main reason for TV holding onto its strong position is that advertising customers can build up high reach within a short space of time and quickly raise awareness of their brands. In contrast, print is becoming gradually less important in the wake of digitalization. This process is likely to continue in the years to come and further increase the relevance of TV as an advertising medium. In the USA (38.1 %), Spain (41.4 %), and France (31.9 %), a large share of advertising expenditure is already allocated to TV, while print is steadily losing market share. A similar structural change is emerging in Germany.

We make active use of these growth opportunities to release additional advertising budgets. For example, the Group conducts extensive market research studies and in particular analyzes which program environments are not yet occupied for print advertising customers in the television market. On this basis, the Group has expanded its portfolio in recent years with target-group-specific stations such as sixx, SAT.1 Gold and ProSieben MAXX and gained numerous new customers (2014: 105) that have advertised on television for the first time. ProSiebenSat.1 will carry on pursuing this multi-station strategy. To this end, in some circumstances the Group will continue complementing its existing station portfolio in order to win print customers over to TV advertising. Models for regional customized advertising are another possibility for acquiring advertising customers, especially companies that have previously relied mostly on print media. ProSiebenSat.1 estimates that regional forms of advertising entails additional market potential of EUR 50 million. In December 2014, the Federal Administrative Court reached a positive verdict in this regard. “Hybrid broadcast broadband TV” (HbbTV) also gives rise to new growth prospects, as advertising messages can be placed individually and tailored to audiences. At the same time, this technology offers the e-commerce business a new sales channel – viewers can order the advertised products directly via their remotes. According to GfK, over 12 million HbbTV-ready sets have been sold in Germany since 2008. The technology is now standard in large parts of Europe, Australia and New Zealand, the Middle East and parts of Asia. In South America and Africa, first countries will start regular service in 2015.

HbbTV combines the high reach of TV with the advantages of the internet: interactivity and a personalized customer approach. However, technical innovations like smart TVs, which make it possible to access the internet and television on one device, not only open new channels for the advertising industry. They also strengthen TV’s position as the most-used medium in Germany. Television in HD quality is also contributing to the fact that TV is becoming increasingly attractive in an environment of intense competition. The distribution of HD programs offers our TV business an substantial growth opportunity with recurring revenue potential independent of the economy. From 2011 to 2018, the market research institute TNS Infratest expects the number of HD households in Germany to nearly double and increase to at least 20 million. 2018, they expect round about 9 million users to pay for an HD program package. If HD spreads more rapidly than expected, this would positively affect our target attainment: By 2018, we want to increase consolidated revenues by a total of EUR 1 billion, of which around EUR 150 million is to come from the distribution of stations.

The future viability of television is based on the high popularity of video. At the same time, TV and online complement each other with regard to advertising intensity as well as viewer and user requirements. This means that TV and the internet are increasingly being used in parallel. In addition to heavier multi-screen use, a rise in paid-content models is emerging. Up to 2018, for example, the pay-VoD market segment relevant to ProSiebenSat.1 is expected to grow by an annual average of 20 % to EUR 450 million. This development will benefit from broadband internet access with high data transmission rates and the growing popularity of mobile devices. In a recent study, PricewaterhouseCoopers expects 57 % of the German population to have a tablet by 2018. Nearly 80 % of Germans are already online. As the ProSiebenSat.1 group has a strong market position in both the TV and digital sector, an acceleration of this trend would have a positive impact on our revenue performance and could lead to the exceeding of our forecast.

In addition to the economic, sector-specific or technological conditions, the regulatory environment could also change more rapidly or more favorably than budgeted and stimulate our growth. For example, additional revenue sources for private TV providers could result from a reduction of advertising offered by public broadcasters. Due to a change to the Interstate Broadcasting Treaty, a sponsorship ban already came into force at the start of 2013, which applies on public television on workdays after 8 p.m. and on Sundays and public holidays, with the exception of large sports events. The Broadcasting Commission of the German Federal States is currently negotiating further changes in view of the current development of fees. Thereafter, a decision is to be made on the issue of a general advertising ban and other structural modifications. The additional volume resulting from a ban on advertising for the public broadcasters could amount to around EUR 300 million by 2018.

Corporate Strategic Decisions

The convergence of media and the increasing relevance of the internet are not only exerting a strong influence on the entertainment industry, but also on digital commerce. Thus, e-commerce business in Germany is expected to grow by 12 % annually in the next two years. Thereby, market shares are gradually shifting from traditional commerce to the digital field, meaning that the German e-commerce market could entail revenues of approximately EUR 52 billion in 2017.

In order to take a share of this dynamic growth, the ProSiebenSat.1 Group is expanding its digital portfolio in a targeted manner and has defined various sectors as strategically relevant: Taking its Travel vertical as a model, the Group is now focusing in particular on Home & Living, Fashion & Lifestyle and Beauty & Accessories. In the medium term, each of the defined verticals promises a double-digit margin and potential revenues of over EUR 100 million.

While the Group has expanded its e-commerce portfolio especially through smaller interests or media-for-equity or media-for-revenue-share partizipations in recent years, in future the Group plans larger bolt-on acquisitions and the increased internationalization of its e-commerce portfolio. We will continue countering potential transaction risks with intensive due diligence and pursuing a leverage factor of 1.5 to 2.5. Key investment criteria include prospects for profitability and synergy potential – i.e. the prospective investments should have the highest possible affinity with TV as an advertising medium or the highest possible interconnectivity with the existing digital portfolio.