Strategy and Management

Vision and Strategic Objectives

We are the leader in our core business of free TV in both the audience market and the advertising market. The Group also has a comprehensive program repertoire of 13,000 hours of own and commissioned productions and 50,000 hours of licensed US programming. Our high reach and attractive content form the basis for our value creation and are also our crucial advantages compared with competitors. The combination of the two provides us with opportunities that are available to almost no other company.

The ProSiebenSat.1 Group has also established a high-reach brand portfolio in its digital business and has positioned itself strategically: Video content is particularly popular on the internet. TV therefore has a much stronger online affinity than any other classic medium. At the same time, TV and online complement each other synergistically in terms of both the intensity of advertising and user loyalty. The ProSiebenSat.1 Group consistently exploits this potential. The Company uses the reach and popularity of its TV stations and digital platforms to build up new brands and grow in related areas. However, the Group achieves revenue synergies not only between its TV and digital business. Integration within the segments is also opening up new areas of growth for the Company. For example, the Group has gradually expanded its portfolio of online travel services and has significantly increased awareness of them in recent months with the aid of TV advertising spots. The integration of mydays into the travel portfolio demonstrates, by way of an example, how high our revenue synergies are. The online portal increased its revenues several times after TV advertisements were broadcast on ProSiebenSat.1 stations, from an average annual growth rate of 2 % to almost 30 % latest. Travel is a visually powerful, emotive subject that appeals to a wide audience. This makes it particularly suited to video advertising. The Company is therefore establishing further e-commerce units along the lines of its travel vertical. Our vision is to develop ProSiebenSat.1 into a Broadcasting, Digital Entertainment and Commerce Powerhouse.

The ProSiebenSat.1 Group is expanding its value chain through new services and consistent digitalization. This allows the Company to reduce the dependence of its growth on fluctuations in TV business due to the economy. This strategy also includes the increased internationalization of the digital business and strategic M&A measures. At the same time, the Company is reinforcing its market leadership in its highly profitable TV business through diversification. With the distribution of its TV stations in HD quality and with basic pay TV services, for example, the Group has been generating additional revenues that are not dependent on the economy for several years.

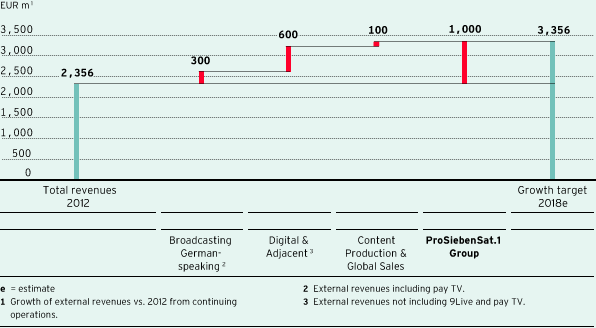

Revenue growth targets 2018

The Company measures the success of this strategy based on the increase in revenues and earnings in the individual segments. The aim is to generate over 40 % of consolidated revenues outside classic TV advertising revenues by 2018. In particular, the Digital & Adjacent segment is expected to reduce the Group’s dependence on the TV advertising market and to account for 25 % to 30 % of consolidated revenues in the medium term. At Group level, ProSiebenSat.1 expects to increase its revenues by EUR 1 billion by 2018 compared with 2012 and to achieve an annual medium single-digit percentage growth in recurring EBITDA.

With a recurring EBITDA margin of around 30 %, ProSiebenSat.1 is one of the most profitable independent media corporations in Europe. Strengthening our profitability at a high level through sustained growth in revenues and earnings is our top priority. The basis for this is a holistic management system. As well as the overriding goal of growth, it reflects the interests of our equity providers and lenders. This includes efficient financial planning and an earnings-oriented dividend policy.

Intragroup Management System

The Group is managed centrally by the Executive Board. This is based on a company-specific management system that takes into account financial and operational performance indicators. These key performance indicators (KPI) are derived from the strategic objectives of the ProSiebenSat.1 Group and broken down for its individual segments and operating Group companies. All KPIs, with the exception of the audience share, can be directly measured in financial terms.

- Revenue and earnings management: The aim of our strategic decisions is to increase revenues continuously and achieve a high level of profitability. As the ProSiebenSat.1 Group operates in a dynamic industry environment, its various operating units must be able to act flexibly. For this reason, while the individual subsidiaries operate on the basis of central objectives, they are also autonomous with full responsibility for revenues and earnings.

Recurring EBITDA is a central key figure that is used to manage profitability of the Group and its segments and subsidaries. Non-recurring income and expenses are adjusted when recurring EBITDA is calculated, so that this key figure reflects the operating profitability in a meaningful way. At the same time, it provides a figure that can be compared at international level, as it does not take into account the effects of taxes and write-downs or the financing structure.

Non-recurring and special items can influence or even overshadow operating performance and can make a multi-year comparison difficult. However, an analysis of unadjusted key earnings figures helps provide a holistic view of the expense and income structure. For this reason, the ProSiebenSat.1 Group uses various key figures to manage profitability:

This is firstly EBITDA. EBITDA stands for earnings before interest, taxes, depreciation and amortization. It serves both at Group level and for the segments as an important performance indicator, being particularly relevant for the Digital & Adjacent segment. The ProSiebenSat.1 Group has successfully increased its revenue and earnings contributions from Digital & Adjacent activities; most recently, the segment generated 21.2 % of total annual revenues (previous year: 18.6 %) and 15.0 % of Group EBITDA (previous year: 13.2 %). As a result, since 2014 the Group’s management system has paid greater attention to segment EBITDA as a KPI in addition to the external revenues generated in the segment.

The underlying net income also measures the Group’s operating performance. The underlying net income represents the adjusted consolidated net profit after non-controlling interests from continuing activities; the effects of purchase price allocations and other special items are not taken into account when it is calculated. The payout ratio for dividends of ProSiebenSat.1 Media AG is calculated on the basis of the Group's underlying net income. - Financial planning: The ProSiebenSat.1 Group invests in markets with long-term growth opportunities and examines options to expand its portfolio. Financial leverage (leverage ratio) is an important parameter used in the Group’s financial planning. It indicates the level of net debt in relation to LTM recurring EBITDA — i.e. the EBITDA adjusted for non-recurring items that the ProSiebenSat.1 Group has generated in the last twelve months (LTM = last twelve months).

- Audience shares: Alongside the financial KPIs mentioned above, non-financial key figures are also used to monitor achievement of our customer, market and service-related targets on an ongoing basis. They contribute indirectly to the achievement of profitability and growth targets.

Audience shares are a key indicator for the core business: Data on television consumption in Germany is collected and analyzed on a daily basis exclusively by GfK Fernsehforschung on behalf of the Arbeitsgemeinschaft Fernsehforschung (AGF). Audience shares measure the reach of programs and are therefore an important means of documenting the operating performance of our free TV stations for the advertising industry. At the same time, this data on consumption is an important performance indicator for our early risk detection system. The ratings achieved are compared with the budgeted figures and systematically recorded as part of risk management.

As well as corporate management on the basis of key figures, cost awareness and requirements in terms of performance are crucial prerequisites for further strengthening the ProSiebenSat.1 Group’s leading position. These include, for example, adequate capitalization for our ratings in the TV advertising market and the development of innovative business ideas. The establishment of a best practice organization therefore constitutes an important strategic task for us. High-performing and motivated employees, guided by a common sense of mission, are the heart of this organization. Clear objectives and appropriate profit-sharing are a key requirement for this. EBITDA is therefore not only an important performance indicator for the management of the Group and its segments, but is also part of the performance-related compensation system for our employees. In addition to net debt, the Company’s EBITDA respectively external revenues and EBITDA of the Digital & Adjacent segment also serve as variable basis for the assessment of the compensation of the Executive Board. By harmonizing the Executive Board’s compensation with our KPI for corporate management, we implemented a holistic and effective control system, which reflects the company-specific characteristics. Further information about individual compensation of Executive Board members can be found in the Compensation Report, while the basics of reporting principles are explained in the chapter “Explanatory Notes on Reporting Principles”.

|

Overview of relevant key performance indicators |

||

|

|

|

|

|

Financial parameters |

Group |

|

|

Non-financial parameter |

Broadcasting German-speaking segment |

|

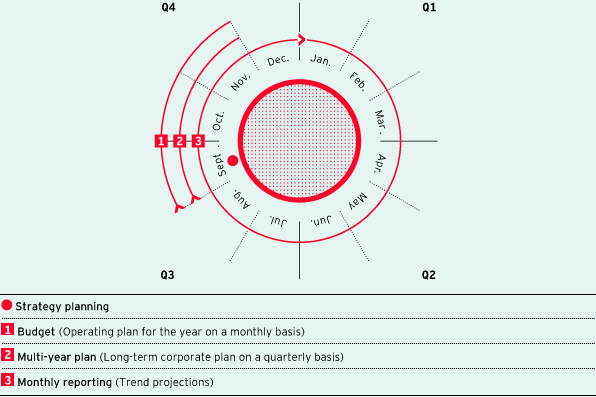

Operational and Strategic Planning

Management and planning are closely intertwined at ProSiebenSat.1: Plans are drawn up on the basis of our corporate strategy, with a focus on the management indicators outlined above. Planning itself is a process that involves multiple stages, in which target figures are defined for the individual KPIs and are stipulated for various time periods. The different levels in the planning process — strategic planning, budget preparation, multi-year planning and monthly reporting — build on each other and are closely linked to our risk management. The diagram below shows the individual planning levels over time for the 2014 financial year:

Planning calendar

- Strategic planning: SWOT analyses are an important strategic planning tool: Market conditions and current key figures for relevant competitors are compared, the company works out its own strengths, and opportunities and risks are assessed. SWOT analyses enable us to determine our competitive position and develop our growth strategy appropriately. The Executive and Supervisory Boards discuss the results once a year in a strategy meeting, in which individual targets are redefined and prioritized as necessary. The strategy meeting for 2014 took place in September, after the Supervisory Board of ProSiebenSat.1 was re-formed in June.

- Budget (operating plan for the year on a monthly basis): Planning for the following year is based on the targets set at the strategy meeting, but specifies these for the operating units and includes objectives for individual financial and non-financial performance indicators on a monthly basis. The Executive and Supervisory Boards of ProSiebenSat.1 Media AG approved the budget at the end of 2014.

- Multi-year planning (long-term corporate plan on a quarterly basis): In turn, the budget for 2015 formed the basis for multi-year planning. It contains targets for a five-year period. The planned figures are calculated in a bottom-up process, like the budget, but are defined on a quarterly basis. To this end, the relevant key financial figures from the income statements or statements of financial position and cash flow statements of individual subsidiaries are analyzed and aggregated at segment and Group level.

- Monthly reporting (trend projections): Also in 2014, the Supervisory Board and the Executive Board regularly discussed the achievement of the ProSiebenSat.1 Group’s short-term and long-term targets. Monthly trend projections are an important tool in planning during the year. They allow the company’s expected performance for the year to be calculated on the basis of the targets achieved to date and to be compared with the target figures that were originally budgeted. The aim is to identify potential discrepancies between the target and actual figures immediately and to implement the necessary countermeasures promptly.

Apart from this monthly reporting to the Executive Board and the Supervisory Board, potential risks are reported to the Group Risk and Compliance Officer on a quarterly basis. In particular, any changes to the early warning risk indicators, such as audience shares, during the year and over time, are analyzed here.