Major Influencing Factors on Financial Position and Performance

Impact of General Conditions on the Business Performance

In 2014, the ProSiebenSat.1 Group increased its TV advertising revenues at a high level and again generated the majority of its revenues from the sale of TV advertising at 66.4 % (previous year: 71.4 %). 89.2 % (previous year: 89.3 %) of this was attributable to the German TV advertising market, the Group’s largest revenue market. ProSiebenSat.1 consolidates TV advertising revenues in the Broadcasting German-speaking segment; the segment increased its external revenues in the business year 2014 by 3.2 % to EUR 2.063 billion (previous year: EUR 1.998 billion).

The German station family expanded its audience shares in 2014 and increased its advertising revenues. In addition to the stations’ wide reach, the growth in revenues was supported by a stable industry environment. The TV advertising market benefited firstly from the positive economic situation in Germany. Secondly, television became even more important as an advertising medium, especially compared to print. Against this backdrop, the ProSiebenSat.1 Group was able to achieve moderate price increases for TV advertising and thus adequately capitalized its market presence. At the same time, the Company expanded its customer base further and gained more than 100 new customers for TV as an advertising medium. Overall, gross investments in TV advertising in Germany climbed by 8.0 % to EUR 13.068 billion, of which ProSiebenSat.1 accounted for 44.0 % (previous year: 43.6 %). The market also grew on the basis of net revenues; growth forecasts for TV advertising average around plus 3 % in 2014.

The basis for the high reach of television and therefore its relevance as an important advertising medium is the appeal of video. This is also true for digital media, as video allows the content of advertising campaigns to be conveyed in a visually powerful and thus particularly emotional manner. The market volume of in-stream videos therefore continued to climb dynamically with a 20.1 % jump to EUR 375.2 million gross. This resulted in growing online revenues overall (+4.0 % to EUR 3.249 billion gross) in 2014. The ProSiebenSat.1 Group significantly increased its gross revenues from the sale of in-stream videos (+22.8 % to EUR 182.4 million) and again confirmed its market leadership with 48.6 %.

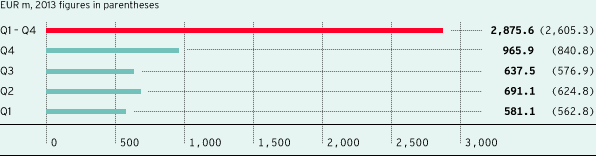

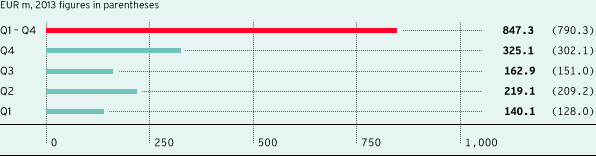

Based on their close link to the economic environment, advertising markets react sensitively and often in a procyclical manner to macroeconomic developments. An important indicator in this respect is private consumption in Germany. In addition, the ProSiebenSat.1 Group’s revenue and earnings performance is characterized by seasonal effects and in particular the importance of the fourth quarter. As both propensity to spend and television use increase significantly in the run-up to Christmas, the Company generates a disproportionately high share of its annual TV advertising revenues in the final quarter. In total, the Group generates approximately a third of its annual revenues and usually around 40 % of its recurring EBITDA in the fourth quarter. This was also true for the past year: The quarterly revenues from October to December 2014 contributed 33.6 % (EUR 965.9 million) to the Group’s annual revenues; the share of recurring EBITDA was 38.4 % (EUR 325.1 million).

Revenues by quarter

Recurring EBITDA by quarter

Other than the economic conditions, digitalization is also affecting our business performance: The growing importance of the internet is changing consumer behavior and media use and is raising the significance of digital commerce. According to Statista and the German Trade Association, the volume of the digital commerce market increased by approximately 18 % to roughly EUR 39 billion in 2014. The digital entertainment market also continued to expand dynamically. Among others, the video-on-demand sector exhibited growth rates of low to mid double-digit percentage.

The ProSiebenSat.1 Group again grew organically in digital commerce and digital entertainment in 2014, but also strengthened its market position with strategic acquisitions at the same time. Overall, the revenues in the Digital & Adjacent segment climbed by a considerable 26.3 %; the segment contributed 21.2 % or EUR 610.7 million to consolidated revenues (previous year: 18.6 % or EUR 483.7 million). In the medium term, the contribution is expected to increase to 25 % to 30 %. This increases the Company’s independence from the economically sensitive advertising market.

Ongoing digitalization is as well giving rise to new growth opportunities for the TV business, which the Group is using consistently. For example, the technical reach and therefore the number of users of HD free TV are increasing continuously. As a result, the ProSiebenSat.1 Group’s distribution revenues also continued to develop dynamically.

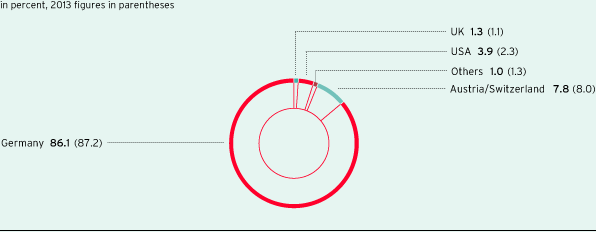

While economic, structural and seasonal effects can significantly influence our business performance, currency fluctuations have only a marginal impact on revenues and costs. Although the Company operates internationally, ProSiebenSat.1 generates the majority of its revenues in Germany and therefore in the euro zone. The Company limits currency risks, which mainly arise from the purchase of licensed programs in the USA, with derivative financial instruments. The chart below illustrates the regional distribution of revenues in 2014:

Revenues by region

Changed interest rates also have no material impact on the earnings situation. The bank loans (Term Loan) and the revolving credit facility (RCF) bear interest at a variable rate. However, the majority of non-current financial liabilities are secured by means of various hedging instruments. As of December 31, 2014, the hedge ratio was approximately 95 % (December 31, 2013: approximately 86 %). In addition, the ProSiebenSat.1 Group had not used its revolving credit facility as of December 31, 2014.

Major Events and Changes in the Scope of Consolidation

Comprehensive refinancing on the bank and bond market. In mid-April 2014, ProSiebenSat.1 Media AG entered into new facilities comprising an unsecured term loan of EUR 1.400 billion as well as an unsecured revolving credit facility (RCF) with an amount of EUR 600.0 million. Both have a term of five years. At the same time, the company successfully concluded the placement of seven-year notes in an amount of EUR 600.0 million.

The proceeds of the notes and the new term loan were used to refinance and replace the senior secured term loan in the amount of EUR 1.860 billion with an original maturity in July 2018. In addition, the new loan is being used for general operating purposes. Through the placement of the notes and the new facilities agreement, the Group has further optimized its financing and placed it on a broader basis at attractive conditions. At the same time, the ProSiebenSat.1 Group extended and diversified its maturity profile. This underscores not only its outstanding financial development in recent years but also its excellent standing on the capital market, thanks to these measures, the Group also expects financing costs and cash flow (before taxes) to improve by approximately EUR 50 million over a period of four years.

Portfolio measures for the transformation into a Broadcasting, Digital Entertainment and Commerce Powerhouse. As part of the Company’s strategic development, the ProSiebenSat.1 Group sold all of its TV and radio stations outside the German-speaking region as planned: The Hungarian TV activities were deconsolidated as of February 25, 2014. The disposal of the subsidiaries connected to the Romanian TV station Prima TV was completed with economic and legal effect on April 2, 2014. Since August 4, 2014, the remaining Romanian subsidiaries have not been included in the ProSiebenSat.1 Group’s consolidated financial statements. The Company sold its Northern European TV and radio portfolio back in December 2012. The transaction was formally and legally completed on April 9, 2013, and the affected companies were deconsolidated. Since then, the ProSiebenSat.1 Group has focused on the strategic expansion of its fast growing Digital & Adjacent segment and its integration with the German-speaking TV business. This offers the Group the biggest synergy and revenue potential in the long term. The aim is to develop the Company into an integrated Broadcasting, Digital Entertainment and Commerce Powerhouse.

Among other fields, the ProSiebenSat.1 Group sees attractive growth perspective in digital entertainment. Part of its growth is organic, but it also takes opportunities to increase business volume with targeted acquisitions and partnerships. In February 2014, the Group acquired Aeria Games Europe GmbH, a publisher specializing in online and mobile games, and expanded its existing games business with new target groups. The company has been fully consolidated since the acquisition was closed on April 1, 2014.

In digital commerce in particular, ProSiebenSat.1 Media AG sees great revenue potential due to synergies between the TV and digital business. In light of this, the Group has identified, developed and established relevant e-commerce verticals in the market: Last year, the ProSiebenSat.1 Group has successively complemented its travel portfolio and bundled it under ProSieben Travel GmbH. An important step was the complete takeover of COMVEL GmbH, operator of travel websites weg.de and ferien.de. COMVEL has been included in the consolidated financial statements of ProSiebenSat.1 Media AG since January 2014. ProSiebenSat.1 has since covered the entire travel-booking cycle, from flights, hotels, and rental cars to local climate and weather data. According to market analysts, the internet travel market is one of the largest and fastest growing industries in the digital retail business. In addition, travel is a visually powerful, emotive subject with high TV affinity that appeals to a broad target group — against the backdrop of digitalization and the increasing convergence of TV and internet this is an important criterion for the Group. Based on the model of the travel business, the ProSiebenSat.1 Group has identified additional e-commerce sectors like “Beauty & Accessories,” “Home & Living” and “Fashion & Lifestyle,” which also offer the Group attractive synergy and revenue potential. For this reason, SevenVentures, the ProSiebenSat.1 Group’s ventures arm, increased its shares in moebel.de (50.1 %) and Flaconi (47.0 %). Both transactions were closed in July 2014.

The Group also expanded its portfolio in the Content Production & Global Sales segment in a targeted manner: ProSiebenSat.1 continued its acquisition strategy in the USA, the most important TV market, by acquiring a majority interest in Half Yard Productions LLC. Half Yard has been fully consolidated since March 2014.

The following table gives an overview of selected portfolio measures. Further information on events in the past financial year is available under “The Year 2014 at a Glance.”

For more information on current changes in the Scope of Consolidation, refer to the Notes, Note 7 ”Acquisitions and disposals“. A detailed description of reporting in line with IFRS 5 can be found in the chapter “Explanatory Notes on Reporting Principles”.

|

Portfolio measures and changes in the scope of consolidation in 2014 |

||

|

|

|

|

|

Broadcasting German-speaking segment |

Launch of the new free TV station ProSieben MAXX Austria in June 2014 |

|

|

Digital & Adjacent segment |

Majority interest in COMVEL GmbH, operator of the travel websites weg.de and ferien.de, in January 2014 |

|

|

|

Founding of ProSiebenSat.1 Travel GmbH in February 2014 |

|

|

|

Acquisition of the online and mobile games publisher Aeria Games Europe GmbH in April 2014 |

|

|

|

Increase of the investment in Flaconi GmbH to 47.0 % in July 2014 |

|

|

|

Increase of the investment in moebel.de Einrichtung & Wohnen AG to 50.1 % in July 2014 |

|

|

|

Completition of the sale of Magic Internet Musik GmbH in August 2014 |

|

|

Content Production & Global Sales segment |

Majority interest in the US production company Half Yard Productions LLC in February 2014 |

|

|

Portfolio measures and changes in the scope of consolidation in 2013 |

||

|

|

|

|

|

Broadcasting German-speaking segment |

Launch of the new free TV station SAT.1 Gold in January 2013 |

|

|

Digital & Adjacent segment |

Majority interest in SilverTours GmbH, operator of the price comparison website billiger-mietwagen.de, in May 2013 |

|

|

|

Majority interest in mydays Holding GmbH, operator of the event present website mydays.de, in May 2013 |

|

|

|

Majority interest in MMP Veranstaltungs- und Vermarktungs-GmbH in August 2013 |

|

|

|

Founding of the multi-channel network Studio71 in September 2013 |

|

|

Content Production & Global Sales segment |

Sale of the shares in the British production company Mob Film Holdings Ltd. |

|