The ProSiebenSat.1 Share

The ProSiebenSat.1 Share on the Capital Market

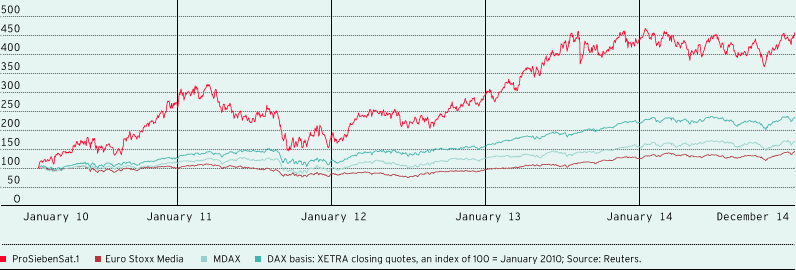

After the German stock market indices saw significant double-digit growth rates in 2012 and 2013, 2014 was a very volatile year. Geopolitical tensions determinated the development of stock markets worldwide. Alongside the political uncertainty in Ukraine, sanctions against Russia and the ongoing crises in Iraq and Syria impacted the capital markets. In addition, the unstable development of commodity prices, weak economic data in the euro zone and the expiry of the Federal Reserve’s bond-purchase program in October 2014 had a negative impact on the stock market climate. On the other hand, the continued expansionary monetary policy of the European Central Bank (ECB), the positive economic situation in the USA and a more favourable economic development in China supported price performance on German stock exchanges.

In 2014, these mutual influences resulted in highly volatile share indices: DAX fluctuated between 8,354.97 points on October 16, 2014, and a hitherto historic high of 10,093.03 points on December 5, 2014. This is a price difference of 20.8 % within seven weeks. Despite the abovementioned geopolitical uncertainties, the DAX closed the trading year at 9,805.55 points, which represents a slight increase of 2.7 % on the final trading day of 2013. The MDAX developed nearly in parallel: It closed at 16,934.85 points and growth of 2.2 % year on year, but it likewise fell short of its highest point to date, 17,183.95 points at the beginning of December 2014. However, the relevant sector index for European media stocks, the Euro Stoxx Media, performed better than the German leading indices with an increase of 8.0 % and 218.5 points as of the end of year.

Price performance of the ProSiebenSat.1 share

In 2012 and 2013, the ProSiebenSat.1 share increased by 50,8 % and 69,0 % respectively, considerably outperforming the comparative indices. The 2014 trading year was weaker in comparison: The ProSiebenSat.1 share closed at the last trading day of 2014 at EUR 34.83, 3.3 % lower than at the end of 2013. Previous year’s price of the share reached the highest level for twelve years.

Overall, the price performance of the ProSiebenSat.1 share over the course of the year reflects the volatility on the German stock market; at the same time, the Group’s good business performance provided positive momentum. In addition, on its Capital Markets Day in October the ProSiebenSat.1 Group announced that it would achieve its revenue growth target for 2015 as soon as the end of the 2014 financial year. The share also registered share price gains at year-end because of optimistic economic and advertising market forecasts.

|

ProSiebenSat.1 share: Basic data |

||

|

|

|

|

|

Name |

ProSiebenSat.1 Media AG |

|

|

Type of share |

Registered common share |

|

|

Stock exchange listing |

Frankfurt Stock Exchange: Prime Standard/regulated market |

|

|

Sector |

Media |

|

|

ISIN |

DE000PSM7770 |

|

|

WKN |

PSM777 |

|

In consideration of the dividend payment of EUR 1.47 per entitled common share resolved at the Annual General Meeting on June 26, 2014, the dividend yield amounted to 4.1 %. The total shareholder return amounted to 2.2 % per ProSiebenSat.1 share in 2014. It was therefore equal to the relevant comparative level of the MDAX (2.2 %).

|

ProSiebenSat.1 share: Key data1 |

||||||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

2014 |

2013 |

2012 |

2011 |

2010 |

||||||||||||||

|

||||||||||||||||||||

|

Share capital at reporting date |

Euro |

218,797,200 |

218,797,200 |

218,797,200 |

218,797,200 |

218,797,200 |

||||||||||||||

|

Number of common shares as of end of reporting period |

Units |

218,797,2002 |

218,797,2002 |

109,398,600 |

109,398,600 |

109,398,600 |

||||||||||||||

|

Number of preference shares as of end of reporting period2 |

Units |

–/– |

–/– |

109,398,6002 |

109,398,6002 |

109,398,6002 |

||||||||||||||

|

Free float market capitalization at end of financial year (according to Deutsche Börse) |

EUR m |

7,271 |

6,024 |

4,660 |

3,089 |

4,923 |

||||||||||||||

|

Close at end of financial year (XETRA) |

Euro |

34.83 |

36.00 |

21.30 |

14.12 |

22.50 |

||||||||||||||

|

High (XETRA) |

Euro |

35.55 |

36.00 |

23.83 |

24.80 |

23.88 |

||||||||||||||

|

Low (XETRA) |

Euro |

28.35 |

21.85 |

14.19 |

11.49 |

8.13 |

||||||||||||||

|

Dividend per entitled common share |

Euro |

–/–3 |

1.47 |

5.63 |

1.15 |

1.12 |

||||||||||||||

|

Dividend per entitled preference share |

Euro |

–/– |

-/- |

5.65 |

1.17 |

1.14 |

||||||||||||||

|

Total dividend |

EUR m |

–/–3 |

313.4 |

1,201.4 |

245.7 |

241.2 |

||||||||||||||

|

Underlying earnings per share4 |

Euro |

1.96 |

1.60 |

1.97 |

3.23 |

1.69 |

||||||||||||||

|

Dividend yield on basis of closing price |

% |

–/–3 |

4.1 |

26.5 |

8.3 |

5.1 |

||||||||||||||

|

Total XETRA trading volume |

Million units |

179.9 |

170.0 |

134.1 |

233.4 |

196.5 |

||||||||||||||

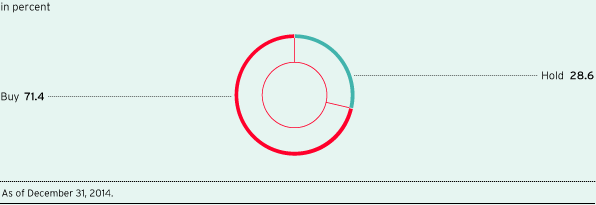

The majority of analysts (71.4 %) recommended the ProSiebenSat.1 share as a buy at the end of 2014; the remaining analysts (28.6 %) came out in favor of holding the share. At the same time, there were no sell recommendations. The analysts’ median price target at the end of the year was EUR 38.00 compared to EUR 34.00 at the end of 2013. In the year under review, a total of 28 brokerage firms and financial institutions actively analyzed the ProSiebenSat.1 share and published research reports. For investors, recommendations by financial analysts are an important basis for decision making.

Analysts’ recommendations

ProSiebenSat.1 Share Represented in Major Indices

ProSiebenSat.1 Media AG’s share is represented in various notable indices. As of December 30, 2014, our weighting in the MDAX, which is calculated on the basis of market capitalization by free float and trading volume in the last twelve months, has amounted to 5.58 %. ProSiebenSat.1 Media AG is therefore the second highest weighted share in the MDAX. The index comprises 50 Prime Standard shares from traditional sectors that follow the 30 companies in the DAX index in terms of market capitalization and trading volume. The Euro Stoxx Media sector index pools stocks from media and media-related companies. The ProSiebenSat.1 Group is represented here with a weighting of 7.45 %.

|

Selected index data |

||||

|

|

|

|||

|

Index |

Weighting |

|||

|

||||

|

MDAX |

5.58 % |

|||

|

Mid Cap |

4.27 % |

|||

|

Prime All Share |

0.71 % |

|||

|

Classic All Share |

3.92 % |

|||

|

Euro STOXX Media |

7.45 % |

|||

Shareholder Structure of ProSiebenSat.1 Media AG

ProSiebenSat.1 shares are mostly held by institutional investors in the USA, UK and Germany. Lavena Holding 1 GmbH was still the biggest shareholder of ProSiebenSat.1 Media AG until the end of January 2014. On January 21, 2014, Lavena Holding 1 GmbH sold its entire remaining shareholding in ProSiebenSat.1 Media AG amounting to 36.3 million common shares. Since this date, all shares except those held by ProSiebenSat.1 Media AG itself have been in free float. Lavena was controlled by funds advised by Kohlberg Kravis Roberts & Co. L.P. (KKR) and Permira Beteiligungsberatung GmbH (Permira) and was until then the Group’s largest shareholder. As a result, the free float of ProSiebenSat.1 shares, and therefore their weight in the MDAX index, increased significantly.

|

Shareholder structure of ProSiebenSat.1 Media AG as of December 31, 2014 |

||||||||||||

|

||||||||||||

|

|

||||||||||||

|

|

|

|

|

|

||||||||

|

Free float |

|

ProSiebenSat.11 |

||||||||||

|

|

|

|

|

|

||||||||

|

97.6 % common shares |

|

2.4 % common shares |

||||||||||

|

|

|

|

|

|

||||||||

|

ProSiebenSat.1 Media AG2 |

||||||||||||

|

|

||||||||||||

2014 Annual General Meeting Elects New Supervisory Board

The Annual General Meeting of ProSiebenSat.1 Media AG for the financial year 2013 was held at the Event Arena in Munich’s Olympiapark on June 26, 2014. Around 350 shareholders, shareholder representatives and guests took part in the meeting. Attendance was around 52 % of original capital.

At the Annual General Meeting, our shareholders elected a new Supervisory Board with a large majority. Following the meeting, Dr. Werner Brandt, CFO of SAP AG until June 30, 2014, was elected as the new Chairman of the Supervisory Board. In addition, the distribution of a dividend of EUR 1.47 per common share was resolved for financial year 2013, which was then paid on June 27. This corresponds to a total dividend of EUR 313.4 million and a distribution ratio of 82.5 % of adjusted consolidated net income for the year. The Annual General Meeting also approved all other resolutions proposed with a large majority.

Dialogue with the Capital Market

Our Investor Relations activities are aligned to the broad and international shareholder structure: We regularly and promptly inform capital market participants and other interested parties of all key events and developments at ProSiebenSat.1 to ensure the transparent communication of financial figures and growth prospects. In addition to 18 road shows, ProSiebenSat.1 was represented at 18 investor conferences in Europe and the US in the 2014 financial year and faced the questions of numerous individual and group meetings with around 800 one-on-ones, including national and international investors, analysts, and bank representatives. The Investor Relations activities were complemented by the ProSiebenSat.1 investor hotline.

The Group also held its fourth Capital Markets Day on October 15, 2014. The Executive Board and division heads provided a detailed insight into current business and informed the capital market comprehensively about the medium-term growth strategy. Around 60 investors, analysts, and bank representatives attended the event at headquarters in Unterföhring, near Munich.

The quality of our capital market communication again received several awards in the 2014 financial year: In the “German Investor Relations Award 2014,” the ProSiebenSat.1 Group took first place out of all MDAX-listed companies, improving further on a good second place in the previous year. The prize is awarded by Thomson Reuters Extel, WirtschaftsWoche and the German Investor Relations Association (DIRK); capital market experts from more than 11,000 buy-side and 2,500 sell-side firms in over 60 countries participated in the survey. ProSiebenSat.1 Media AG achieved another first place in the “2014 All-Europe-Executive Team Ranking,” which is published by the Institutional Investor magazine, in the media segment assessed by sell-side analysts. Over 2,000 portfolio managers and buy- and sell-side analysts were surveyed. In addition, the Investor Relations work took the top spot among MDAX companies in the “Investors’ Darling” award bestowed by manager magazin and HHL Leipzig Graduate School of Management. In the overall ranking, looking at annual and interim reports, investor presentations, and Investor Relations websites, the ProSiebenSat.1 Group took third place in the MDAX and eighth place in the overall evaluation of all 160 largest German listed stock companies. Our Annual Report also won another award: The Corporate Communication Institute (CCI) selected the 2013 Annual Report in both the categories Print and Online as the best in the MDAX.

1 This section is part of the audited Group management report.