Group Financial Position and Performance

Principles and Objectives of Financial Management

Risk control and centralized management are key principles of the ProSiebenSat.1 Group’s financial management. The Company’s financial management is centrally run by the Group Finance & Treasury department. This department manages the Group’s financing activities and is the contact for all managing directors and employees in the Group responsible for finance. The prevailing objectives are:

- to ensure that the entire ProSiebenSat.1 Group remains solvent by managing its liquidity efficiently across the organization,

- to secure its financial flexibility and stability, in other words, maintaining and optimizing its funding ability,

- to manage its financial risks by using derivative financial instruments.

The Group financial management covers the capital structure management and Group-wide funding, cash and liquidity management, and the management of market price risks, counterparty risks and credit default risks.

- The aim of capital structure management is to optimize the way in which the Group’s capital structure and funding are organized using a range of financial instruments. These include equity or equity-like instruments as well as debt funding. In its choice of suitable financing instruments, the Company takes into account factors such as the level of market receptivity, funding terms and conditions, flexibility or restrictions, diversification of the investor base and maturity profiles. The ProSiebenSat.1 Group records and manages its debt funding on a centralized basis. This enables the Group to obtain economies of scale and optimize its cost of capital. In connection with capital structure management at the ProSiebenSat.1 Group, managing financial leverage (leverage factor) is given particular priority.

- As part of its cash and liquidity management, the Group optimizes and centralizes cash flows and secures liquidity across the Group. Cash pooling is an important tool here. Using rolling, Group-wide liquidity planning the ProSiebenSat.1 Group captures and forecasts both operating cash flows and cash flows from non-operating activities, thus deriving liquidity surpluses or requirements. Liquidity requirements are covered either by existing cash positions or the revolving credit facility (RCF).

- The management of market price risks comprises centrally managed interest rate and currency management. The objective is to limit the effects of interest and currency volatility to Group profit and cash flow. Cash instruments as well as derivatives such as conditional and unconditional forward transactions are deployed. These instruments are used exclusively for hedging purposes.

The management of counterparty and credit default risks centers on trading relationships and creditor exposure to financial institutions. When entering into trading transactions, the ProSiebenSat.1 Group pays attention to ensuring that business is widely diversified involving counterparties of sufficiently high credit quality. For this purpose, the Group draws on external ratings supplied by international agencies. The Group’s risk with respect to financial institutions arises primarily from its investment of cash and cash equivalents and from its use of derivatives as part of its interest-rate and currency management activities.

Borrowings and Financing Structure

As of December 31, 2014, 62.7 % or EUR 1.973 billion of debt capital of the ProSiebenSat.1 Group comprised non-current financial liabilities (December 31, 2013: 62.0 % and EUR 1.842 billion). As of the reporting date as well as previous year, there were no current financial liabilities. The share of debt capital in total assets decreased to 80.7 % compared to the end of 2013 (December 31, 2013: 83.6 %).

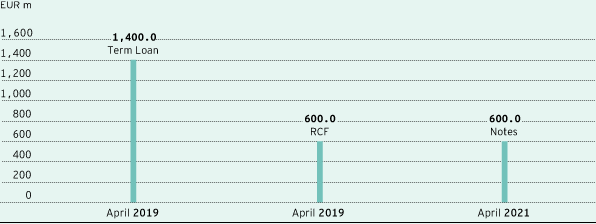

On April 2, 2014, for the purposes of comprehensive refinancing, the ProSiebenSat.1 Group concluded a new syndicated facilities agreement for EUR 2.000 billion with a five-year term to April 2019. This new unsecured facilities agreement comprises a term loan of EUR 1.400 billion and a revolving credit facility of EUR 600.0 million. ProSiebenSat.1 also issued seven-year notes in the amount of EUR 600.0 million in the context of Group refinancing. The notes are also unsecured and will mature in April 2021. They are listed on the regulated market of the Luxembourg stock exchange (ISIN DE000A11QFA7).

The proceeds of the notes and the new term loan were used to prepay the senior secured term loan in the amount of EUR 1.860 billion. The new term loan is also being used for general operating purposes.

The following graph provides an overview of debt instruments together with amounts and maturities following refinancing:

Rating of the ProSiebenSat.1 Group: Ratings represent an independent assessment of a company’s credit quality. The rating agencies do not take the ProSiebenSat.1 Group’s facilities agreement or notes into account in their credit ratings.

Debt financing and maturities as of December 31, 2014

- The nominal amount of the new term loan was EUR 1.400 billion as of December 31, 2014. The previous term loan D totaled EUR 1.860 billion as of the previous year’s reporting date.

- As of the balance sheet date, the new revolving credit facility amounts to EUR 600.0 million. As of December 31, 2013, the Group had total available facilities likewise of EUR 600.0 million. As in the previous year, no cash drawings were made as of December 31, 2014.

- Maturing in 2021, the notes in the amount of EUR 600.0 million contribute to the diversification of the financial basis of ProSiebenSat.1’s financial liabilities.

Interest payable on the term loan and the amounts drawn under the RCF are variable. The ProSiebenSat.1 Group hedges risks from the change of variable interest rates with derivative financial instruments in the form of interest rate swaps and interest rate options. In relation to the entire long-term financing portfolio, the hedge ratio of fixed interest was approximately 95 % as of December 31, 2014 (December 31, 2013: approximately 86 %). The average fixed-interest swap rate is around 3.12 % per annum (previous year: around 3.86 %). The fixed-rate coupon of the notes is 2.625 % per annum.

The ProSiebenSat.1 Group has also concluded lease contracts for property at the Unterföhring site. In line with IFRS, these are largely classified as finance leases. This real estate is capitalized as property, plant and equipment and the respective leasing obligations are recognized as other financial liabilities. The real estate leases end in 2019 at the earliest. There are also smaller-scale leases for technical equipment. The ProSiebenSat.1 Group reported liabilities for finance leases totaling EUR 89.2 million as of December 31, 2014 (previous year: EUR 91.7 million). There were no other significant off-balance sheet financing instruments.

|

Group-wide corporate financing |

|

|

|

ProSiebenSat.1 Media AG has an unsecured syndicated facilities agreement which, as of December 31, 2014, includes a term loan of EUR 1.400 billion and a revolving credit facility with a facility amount of EUR 600.0 million. The facilities agreement contains provisions that require ProSiebenSat.1 to comply with certain key financial figures (financial covenant), which are subject to regular reviews. Thus, the ProSiebenSat.1 Group has to satisfy a certain ratio of the consolidated net debt to the consolidated EBITDA (as defined in the contract). The ProSiebenSat.1 Group complied with the contractual requirements in the 2014 financial year. |

|

In the event that the control over ProSiebenSat.1 Media AG changes by way of direct or indirect acquisition of more than 50 % of the voting rights in ProSiebenSat.1 Media AG by a third party (change of control), the lenders are entitled to terminate their participation in the facility and to demand repayment of outstanding amounts allocable to them within a certain period after the change of control takes place. |

|

In addition, ProSiebenSat.1 Media AG has outstanding unsecured notes of EUR 600.0 million. In the event that the control over ProSiebenSat.1 Media AG changes by way of direct or indirect acquisition of more than 50 % of the voting rights in ProSiebenSat.1 Media AG by a third party (change of control) and a negative rating event occurs following such a change of control, the note creditors are entitled to call in their notes and demand repayment. |

Financing Analysis

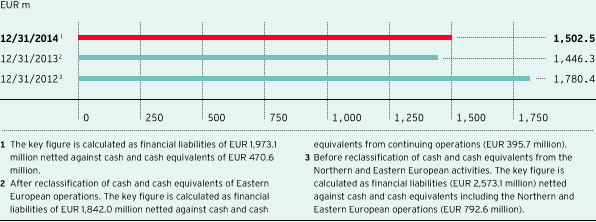

Net financial debt was EUR 1.502 billion and therefore nearly at the same level as the previous year (EUR 1.446 billion). It is defined as total financial liabilities minus cash and cash equivalents and certain current financial assets. As of the end of the year, cash and cash equivalents amounted to EUR 470.6 million compared to EUR 395.7 million on December 31, 2013.

Group net financial debt

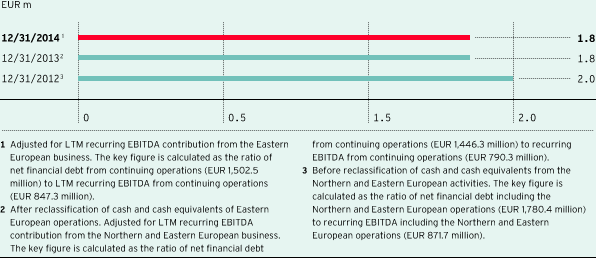

The leverage factor was also at prior year level at 1.8 times and thus within the defined target range of 1.5 to 2.5 times. This ratio shows net financial debt in relation to recurring EBITDA of the last twelve months (LTM recurring EBITDA) and is a key indicator for our Group-wide financial planning.

Ratio net financial debt to LTM recurring EBITDA1

Analysis of Liquidity and Capital Expenditure

The ProSiebenSat.1 Group’s cash flow statement shows the generation and use of cash flows. It is broken down into cash flow from operating activities, cash flow from investing activities and cash flow from financing activities. Cash and cash equivalents shown in the cash flow statement correspond to cash and cash equivalents reported in the statement of financial position as of December 31, 2014, and December 31, 2013, respectively.

|

Cash flow statement |

||||||||||

|

|

|

|

|

|

||||||

|

EUR m |

Q4 2014 |

Q4 2013 |

2014 |

2013 |

||||||

|

||||||||||

|

Profit from continuing operations |

169.4 |

156.7 |

381.5 |

364.6 |

||||||

|

Profit from discontinued operations |

-18.4 |

-95.6 |

-27.1 |

-47.6 |

||||||

|

Cash flow from continuing operations |

572.5 |

529.7 |

1,690.0 |

1,626.1 |

||||||

|

Cash flow from discontinued operations |

-2.3 |

13.2 |

-4.6 |

108.2 |

||||||

|

Change in working capital |

9.9 |

62.9 |

-12.2 |

-14.8 |

||||||

|

Dividends received |

0.1 |

-/- |

5.7 |

5.9 |

||||||

|

Income tax paid |

-41.2 |

-32.2 |

-163.4 |

-135.6 |

||||||

|

Interest paid |

-17.9 |

-33.6 |

-91.2 |

-137.0 |

||||||

|

Interest received |

1.8 |

3.0 |

2.1 |

3.8 |

||||||

|

Cash flow from financing costs from derivatives |

-/- |

-/- |

-6.3 |

-/- |

||||||

|

Cash flow from operating activities of continuing operations |

525.2 |

529.8 |

1,424.8 |

1,348.3 |

||||||

|

Cash flow from operating activities of discontinued operations |

-0.1 |

9.3 |

19.5 |

58.4 |

||||||

|

Cash flow from investing activities of continuing operations |

-227.9 |

-223.4 |

-1,148.4 |

-1,018.3 |

||||||

|

Cash flow from investing activities of discontinued operations |

-2.4 |

-17.0 |

-25.2 |

1,181.9 |

||||||

|

Free cash flow of continuing operations |

297.3 |

306.4 |

276.5 |

330.1 |

||||||

|

Free cash flow of discontinued operations |

-2.6 |

-7.6 |

-5.7 |

1,240.3 |

||||||

|

Free cash flow (total) |

294.7 |

298.8 |

270.7 |

1,570.4 |

||||||

|

Cash flow from financing activities of continuing operations |

-2.7 |

-105.0 |

-208.3 |

-1,953.2 |

||||||

|

Cash flow from financing activities of discontinued operations |

0.0 |

0.0 |

0.0 |

-2.3 |

||||||

|

Effect of foreign exchange rate changes of continuing operations on cash and cash equivalents |

1.9 |

0.5 |

4.0 |

-0.9 |

||||||

|

Effect of foreign exchange rate changes of discontinued operations on cash and cash equivalents |

0.0 |

0.0 |

-0.3 |

-2.2 |

||||||

|

Change in cash and cash equivalents total |

293.8 |

194.3 |

66.1 |

-388.2 |

||||||

|

Cash and cash equivalents at beginning of reporting period |

176.81 |

210.21 |

404.51 |

792.61 |

||||||

|

Cash and cash equivalents at end of reporting period |

470.6 |

404.51 |

470.6 |

404.51 |

||||||

|

Cash and cash equivalents classified under assets held for sale at end of reporting period |

–/– |

-8.8 |

-/- |

-8.8 |

||||||

|

Cash and cash equivalents from continued operations at end of reporting period |

470.6 |

395.7 |

470.6 |

395.7 |

||||||

Cash flow from operating activities: In the 2014 financial year, the ProSiebenSat.1 Group generated an operating cash flow of EUR 1.425 billion compared to EUR 1.348 billion in the previous year. This equates to a growth of 5.7 %. The increase is primarily due to the positive earnings performance and lower interest payments year-on-year. The reduction in interest payments of EUR 45.8 million to EUR 91.2 million (previous year: EUR 137.0 million) is mainly attributable to the Group’s refinancing. In the second quarter of 2014, ProSiebenSat.1 restructured its financial liabilities and refinanced its loans at more favorable conditions. This was offset in the past financial year by higher tax payments of EUR 163.4 million (previous year: EUR 135.6 million).

Detailed information on off-balance sheet investment obligation can be found in the Notes, Note 34 “Other financial obligations".

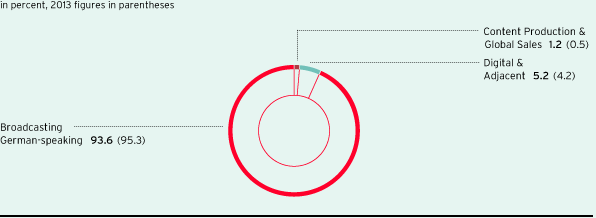

Cash flow from investing activities: The core area of investing activities within ProSiebenSat.1 is the acquisition of programming rights. The Group secures attractive programs through three different channels: by purchasing licensed formats, through commissioned productions and through in-house formats that are based on the development and implementation of own ideas. In contrast to commissioned productions, in-house formats are primarily produced with a view to being broadcast in the near future. For this reason, they are recognized immediately as an expense in the cost of sales and are not considered an investment. In the past financial year, cash outflow for the acquisition of programming rights amounted to EUR 889.7 million, up 3.4 % or EUR 29.5 million (previous year: EUR 860.2 million). The vast majority of investments were nearly fully made in the Broadcasting German-speaking segment, almost half for the acquisition of licensed programming and half for commissioned productions.

In the past financial year, besides investments in programming assets, EUR 66.4 million were invested in intangible assets, an increase of 7.5 % or EUR 4.6 million compared to the prior year figure. With shares of 54.3 % and 34.1 % respectively, the majority of investments in intangible assets were made in the Digital & Adjacent and Broadcasting German-speaking segments. They primarily reflected the acquisition of client business and software licenses. Investments made in property, plant and equipment were nearly at the level of the previous year at EUR 32.8 million (previous year: EUR 32.0 million) and were predominantly in the Broadcasting German-speaking segment at 85.4 %. Most of the investments related to technical equipment, leasehold improvements at the Unterföhring site and advance payments for property, plant and equipment. Furthermore, the Group´s investments increased by EUR 65.6 million to EUR 122.2 million for the extension of the consolidation scope (previous year: EUR 56.6 million).

In the past financial year, the following breakdown by segment resulted from the described cash flows from investing activities:

Investments by segment from continuing operations

Assets resulting from initial consolidations are not reported as segment-specific investments. Funds used for the acquisition of the first-time consolidated companies are shown as ”cash outflow from additions to the scope of consolidation“.

Cash outflows from additions to the scope of consolidation were primarily related to corporate acquisitions in the Digital & Adjacent segment, but were also related to the Content Production & Global Sales segment. The acquisitions serve to strengthen the respective business areas in the two segments.

Against the backdrop of higher investments in programming assets and cash outflows for additions to the scope of consolidation, cash flow from investing activities from continuing operations rose to minus EUR 1.148 billion. This equates to an increase of 12.8 % or EUR 130.1 million compared to 2013.

There was a net cash outflow of EUR 6.4 million in the reporting period resulting from the sale of the Hungarian and Romanian operations. In April 2013 the ProSiebenSat.1 Group generated a cash inflow of EUR 1.312 billion from the disposal of the Northern European activities. This net cash outflow or inflow is reported as cash flow from investing activities of discontinued operations.

Free cash flow: Free cash flow from continuing operations fell by 16.2 % to EUR 276.5 million in the 2014 financial year (previous year: EUR 330.1 million). The decline is primarily attributable to the higher volume of investment in connection with company acquisitions and participations.

Cash flow from financing activities: In the last financial year, cash outflow from financing activities was net EUR 208.3 million after cash outflow of net EUR 1.953 billion in the previous year. The payment of the dividend for the 2013 financial year of EUR 313.4 million resulted in a cash outflow in June 2014. This was offset by a net cash inflow of EUR 116.3 million in connection with the repayment of the loan in the second quarter of 2014. The high cash outflow in the previous year reflects the dividend payment (EUR 1.201 billion) as well as the repayment of loans amounting to EUR 730.7 million.

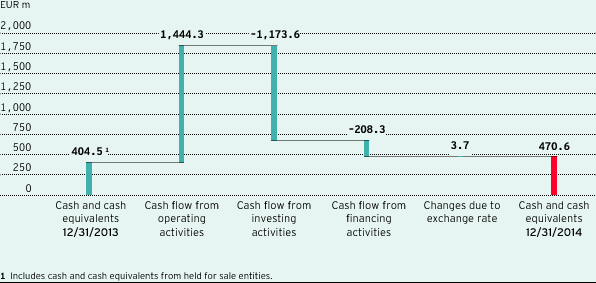

Cash and cash equivalents: In the 2014 financial year, the overall cash flows described resulted in an increase of cash and cash equivalents compared to the previous year’s reporting date. At EUR 470.6 million, the cash and cash equivalents were 18.9 % or EUR 74.9 million higher than the previous year’s figure of EUR 395.7 million. In the fourth quarter, the Group generated cash and cash equivalents totaling EUR 293.8 million (previous year: EUR 194.3 million).

Changes in cash and cash equivalents total

Analysis of Assets and Capital Structure

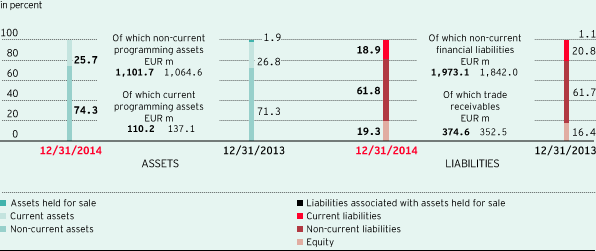

As of December 31, 2014, total assets amounted to EUR 3.901 billion compared to EUR 3.556 billion on December 31, 2013. The 9.7 % increase in total assets primarily resulted from higher intangible and financial assets.

Structure of the statement of financial position

Significant individual value changes to items of the statement of financial position compared to December 31, 2013, are described below:

As of December 31, 2014, intangible assets increased by 12.3 % to EUR 1.307 billion (December 31, 2013: EUR 1.165 billion). This was mainly due to the first-time consolidations and purchase price allocations of COMVEL GmbH, Half Yard Productions LLC and Aeria Games Europe GmbH. Accordingly, the share of intangible assets in total assets increased to 33.5 % as of December 31, 2014 (December 31, 2013: 32.7 %).

Non-current other financial and non-financial assets rose considerably by EUR 157.2 million to EUR 222.1 million as of December 31, 2014 (December 31, 2013: EUR 64.9 million). This was the result of positive effects from currency hedges and the addition of financial instruments recognized at fair value through profit or loss.

Non-current and current programming assets increased slightly compared to December 31, 2013. They increased by 0.9 % and amounted to EUR 1.212 billion (December 31, 2013: EUR 1.202 billion). Alongside intangible assets, programming assets are among the most important assets in the ProSiebenSat.1 Group’s statement of financial position with a share of almost one third.

Trade receivables fell by a total of 2.5 % or EUR 8.2 million to EUR 318.1 million.

Current other financial and non-financial assets rose to EUR 75.2 million (December 31, 2013: EUR 42.2 million). This equates to an increase of 78.1 % or EUR 33.0 million, which is mainly attributable to positive effects from currency hedges.

Cash and cash equivalents increased to EUR 470.6 million as of the reporting date, an increase of 18.9 % or EUR 74.9 million.

The assets held for sale were derecognized in full in the 2014 financial year as a result of the deconsolidation of the Hungarian and Romanian activities. On December 31, 2013, the carrying amount of the assets held for sale was EUR 68.8 million.

In the reporting period, equity rose by 29.1 % to EUR 753.9 million (December 31, 2013: EUR 584.1 million). A positive impact was made by the consolidated profit of EUR 354.3 million and the EUR 121.4 million increase in other accumulated equity. This was counteracted by the dividend payment of EUR 313.4 million. Accordingly, the equity ratio increased to 19.3 % (December 31, 2013: 16.4 %). In view of the described equity effects, the Group has a solid financial position.

As of December 31, 2014, non-current and current liabilities and provisions increased to a total of EUR 3.147 billion (December 31, 2013: EUR 2.972 billion), a rise of 5.9 %. A reason for the change is the refinancing implemented in 2014, which led to an increase of financial liabilities by 7.1 % or EUR 131.1 million to EUR 1.973 billion. In addition, trade payables increased by 10.3 % or EUR 38.6 million in the reporting period to EUR 411.7 million, mainly due to the purchase of programming assets. Other non-current and current liabilities and provisions also posted an increase of 17.0 % or EUR 38.6 million to EUR 266.3 million, in particular because of higher liabilities from the obligation to provide advertising time.

In contrast, other non-current and current financial liabilities decreased by 15.7 % or EUR 49.0 million to EUR 262.4 million, primarily due to positive effects from currency hedges and the reduction of purchase price liabilities.

In addition, the liabilities associated with assets held for sale were fully derecognized in connection with the deconsolidation of the Hungarian and Romanian activities in the 2014 financial year. On December 31, 2013, a book value of EUR 40.2 million was recognized for liabilities associated with assets held for sale.

As of December 31, 2014, there were no other major structural or quantitative changes of the statement of financial position year-on-year.

|

Accounting assumptions and estimates |

|

|

|

When applying accounting principles, recognizing income and expenses and preparing balance sheet reports, assumptions and estimates need to be made to a certain extent. Detailed information on the use of assumptions and estimates are shown in Note 2 of the consolidated financial statements. |