Basic Principles of Media Policy and Legal Environment

Regulatory Conditions

Like almost all European countries, Germany has a dual broadcasting system including private and public operators. The ProSiebenSat.1 Group is the market leader in terms of audience ratings and advertising. The private providers operate as independent commercial enterprises, obtaining most of their revenues from marketing advertising. They finance more than 280 TV stations and nearly 260 radio stations with a budget of EUR 7.1 billion (2012). In comparison, public broadcasters operate around 20 TV stations and 70 radio stations with a budget of EUR 8.6 billion. The duty of the public broadcasting organizations, with the main stations ARD and ZDF, is to provide a “basic service to the population including information, education, culture and entertainment”. Their financing has to date been ensured by the law on license fees. Public broadcasters also receive advertising revenues.

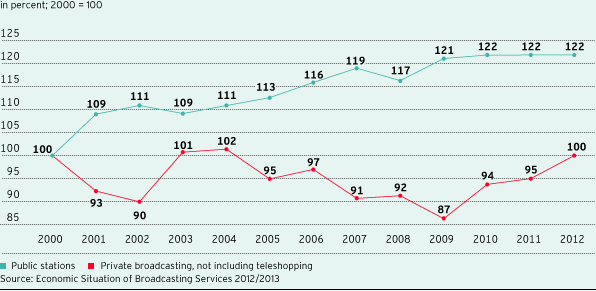

The dual system has become significantly unbalanced in the last few years from the point of view of the private broadcasters, as income from license fees has risen continuously:

Change in total revenues in broadcasting in comparison

In 2000, the monthly fee was DM 28.25 or EUR 14.44 per TV. By 2012, it was EUR 17.98 per TV. In view of the increasing convergence of devices, the amount of the license fee is no longer based on the number of devices as of January 2014. A standardized fee is now paid per household, regardless of the type and number of devices. The switch to the new license fee model has led to a further increase in public broadcasters’ income from license fees. No figures were available for 2014 at the time of going to press; however, the committee for determining the financial requirements of broadcasters (Kommission zur Ermittlung des Finanzbedarfs der Rundfunkanstalten, KEF) predicts additional income totaling EUR 1.145 billion for the period from 2013 to 2016. The KEF has thus recommended lowering the license fee by 73 cents to EUR 17.25. As a first step, the federal states have decided to reduce the fee by 48 cents to EUR 17.50 from 2015. The difference is to be made available for structural measures, such as a reduction in advertising in public television. The KEF only recently investigated the potential for, and the impact of, a partial reduction or even a complete ban on advertising for public operators.

In no European country do the public broadcasters have similarly high budgets to those in Germany. However, market analyses show that these broadcasters are reaching ever fewer young people with their main channels, ARD and ZDF. In order to counteract this trend, the public broadcasters are expanding with specialist digital channels and online offerings. These plans are being critically discussed by the government, as in some respects they go beyond the public broadcasters’ original mandate to provide basic services.

However, private operators in Germany are not only competing with well-funded public broadcasters. The advancing market penetration of convergent devices means that the internet is increasingly being used through television sets. This is leading to a fundamental change in the competitive situation. Not only is the variety of media offerings increasing, but digitalization is facilitating the market entry to international competitors. However, US providers like Google and Facebook are not subject to the same regulations as German companies when it comes to issues such as copyright law, restrictions on advertising or legal requirements for the protection of young people. Furthermore, quantitative and qualitative restrictions make fair competition difficult. TV is more tightly regulated than other media in Germany in terms of both advertising and content. For example, time for German TV advertising is restricted to a maximum of twelve minutes per hour, while opportunities to place advertising in certain programs are limited. In addition, private broadcasting is regulated by German media concentration legislation and programming restrictions. To ensure plurality of opinion, SAT.1, for example, has to finance regional programs for a total of five broadcast areas and has to broadcast these in parallel during prime time. The Interstate Broadcasting Treaty also places an obligation on some private operators to finance and broadcast programs from independent third-party companies. Legal proceedings are currently pending regarding SAT.1’s current controversial obligation to broadcast these third-party programs. A new political dialogue is also taking place regarding regional commercial breaks during television programs that are broadcast nationwide. In December 2014, the Federal Administrative Court (BVerwG) ruled in favor of ProSiebenSat.1, that different regional advertising was permissible during television programs that can be received throughout Germany. Decentralized forms of advertising are already established in many other EU member states.

Discussions have been ongoing for several years as to whether the dual concept in Germany still adequately reflects the division of responsibilities between private and public broadcasters or whether a fundamental reform of the general framework is needed. This debate has been intensified in view of globalization, which is also increasingly changing the media landscape. ProSiebenSat.1 believes that new media structures are required to ensure equal regulation criteria for all providers on the German market, while simultaneously taking account of changes due to digitalization. The ProSiebenSat.1 Group therefore participates actively in various political discussions such as the “Media Policy Round Table” in Bavaria and the “Media Dialog” in Hamburg. The aim is to formulate recommendations for action together with other media companies and representatives of internet and media policy in state and federal governments. The first results are expected to be translated into concrete plans for legislation during the current legislative period.

Distribution of TV Programs and Technological Conditions

As well as the special status of public broadcasters, the German television market is characterized in particular by the extensive range of high-quality free TV broadcasters that are financed through advertising. This explains the comparative reluctance to pay for TV programs: While 17 % of viewers currently subscribe to pay TV programs in Germany, media companies in the USA generate around 84 % of their revenues from pay TV stations. The level of market penetration is even higher in Scandinavian countries, at 88 %. However, ongoing digitalization is also opening up new opportunities for free TV stations in Germany to refinance their programming offer. Stations in the ProSiebenSat.1 Group have been broadcasting in HD resolution in addition to standard quality since 2009. Since then, the Group has benefited from a technical service fee from the distribution of its HD stations and has generated rapidly growing revenues from this.

|

TV households in Germany by delivery technology |

||||||||||||||

|

|

|

|

|

|

|

|||||||||

|

TV households |

Potential in millions |

Terrestrial |

Cable |

Satellite |

IPTV |

|||||||||

|

||||||||||||||

|

2013 |

36.24 |

1.34 |

16.48 |

16.87 |

1.55 |

|||||||||

|

20141 |

36.71 |

1.38 |

16.59 |

17.15 |

1.59 |

|||||||||

The number of TV households is rising continuously; in particular, distribution of programs via satellite is becoming increasingly widespread in Germany, and overtook the number of households with cable for the first time in 2013. Satellite connections now represent the most important distribution channel. They have a relatively wide range and simultaneously offer almost blanket coverage. Against this backdrop, the number of households receiving TV via satellite had risen to 17.15 million by the end of the year (previous year: 16.87 million). 16.59 million German households had access to cable TV (previous year: 16.48 million).

A crucial growth driver of this shift in delivery technology is new technologies, particularly the increasing popularity of high-resolution television in HD quality. The number of users of the digital satellite platform HD+, via which private stations in Germany are distributed, had risen to 5.3 million by the end of 2014 (previous year: 4.2 million). This represents a growth of about one quarter.