Comparison of Actual and Expected Business Performance

The ProSiebenSat.1 Group closed the 2014 financial year with record figures. The Company hit all targets for the relevant financial and non-financial performance indicators, and even exceeded most of them.

|

Comparison of the actual and forecast business performance for the Group1 |

||||||||

|

|

|

|

|

|

||||

|

EUR m |

Actual figures 2013 |

Actual figures 2014 |

Change |

Forecast 2014 |

||||

|

Revenues |

2,605.3 |

2,875.6 |

+10.4 % |

High single-digit increase |

||||

|

Recurring EBITDA |

790.3 |

847.3 |

+7.2 % |

Mid single-digit increase |

||||

|

Underlying net income |

379.7 |

418.9 |

+10.3 % |

High single-digit increase |

||||

|

Leverage |

1.8 |

1.8 |

-/- |

1.5 – 2.5 |

||||

|

Comparison of the actual and forecast business performance for the segments1 |

||||||||||

|

|

|

|

|

|

||||||

|

|

Revenues |

Recurring EBITDA |

||||||||

|

in percent |

Forecast |

Change |

Forecast |

Change |

||||||

|

||||||||||

|

Broadcasting German-speaking |

Slight increase |

+3.2 % |

Slight increase |

+3.6 % |

||||||

|

Digital & Adjacent |

Significant increase |

+26.3 % |

Significant increase |

+22.7 % |

||||||

|

Content Production & Global Sales |

Significant increase |

+63.4 % |

Significant increase |

+80.1 % |

||||||

The ProSiebenSat.1 Group publishes its targets in the annual report and adjusts them during the year if necessary. In view of its good revenue performance, the Company specified its growth target for the ongoing financial year in mid-October 2014:

At Capital Markets Day, we announced the achievement of the upper end of the forecast growth rate and therefore the increase of the Group’s annual revenues by a high single-digit percentage. In 2014, consolidated revenues grew to EUR 2.876 billion (previous year: EUR 2.605 billion). This equates to an increase of 10.4 % compared to the 2013 financial year. At the beginning of the year, we still expected an increase of a mid to high single-digit percentage. All three segments contributed to the positive revenue performance.

At the same time, in fall 2014, the Company also announced the early achievement of its originally medium-term revenue targets for 2015 and confirmed its current medium-term revenue target for 2018.

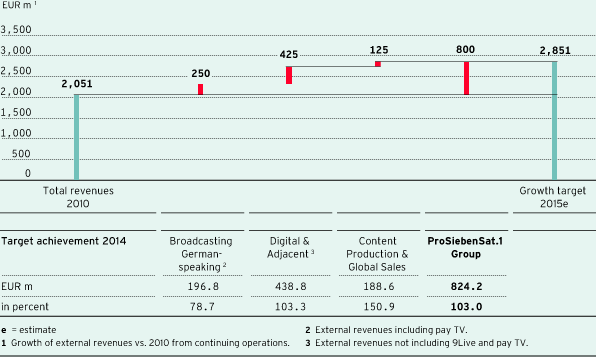

In some cases, the expansion of the growth areas was advanced more quickly than planned. For this reason, we already achieved our target for 2015, a revenue increase of EUR 800 million compared to 2010, one year earlier. As of the end of 2014, Group revenues rose to EUR 2.876 billion. The Group grew mostly organically, but at the same time strengthened its position due to acquisitions.

Revenue growth targets 2015 und degree of achievement

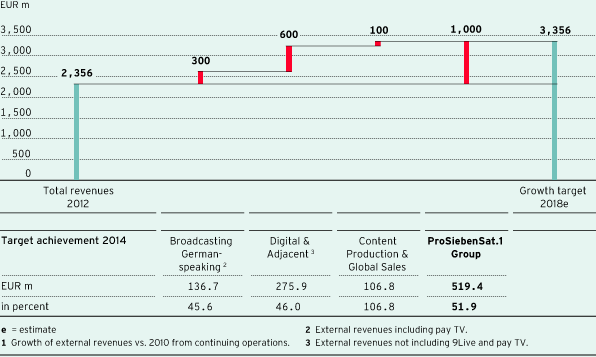

For 2018, the ProSiebenSat.1 Group is aiming for growth in consolidated revenues of EUR 1 billion compared to the financial year 2012. As of the end of the year, we had already achieved 51.9 % of this target. This is primarily based on the high revenue increase in the Digital & Adjacent (+26.3 % compared to 2013) and Content Production & Global Sales (+63.4 % compared to 2013) segments. The Broadcasting German-speaking segment developed as planned with a revenue increase of 3.2 % compared to 2013. We forecast market-level growth for segment revenues in the year as a whole; based on net revenues, we expected the market to grow by a low single-digit percentage.

Revenue growth targets 2018 und degree of achievement

ProSiebenSat.1 grew profitably in all segments in 2014. In total, the Group’s recurring EBITDA increased by 7.2 % to EUR 847.3 million. The underlying net income for 2014 increased by 10.3 % to EUR 418.9 million.

The financial position also developed as planned: As of the end of the year, the leverage factor was 1.8 and was thus within the target range of 1.5 to 2.5. The Group therefore achieved all financial targets announced for 2014.

This also applies to the development of viewer ratings, the central non-financial parameter. The German station family had a combined market share of 28.7 % in 2014 (previous year: 28.1 %) and remains the market leader. ProSiebenSat.1’s target was at least to maintain its market lead in a fiercely competitive environment. The Company succeeded in doing so despite the broadcast of the Soccer World Cup and the Winter Olympic Games on the public stations.